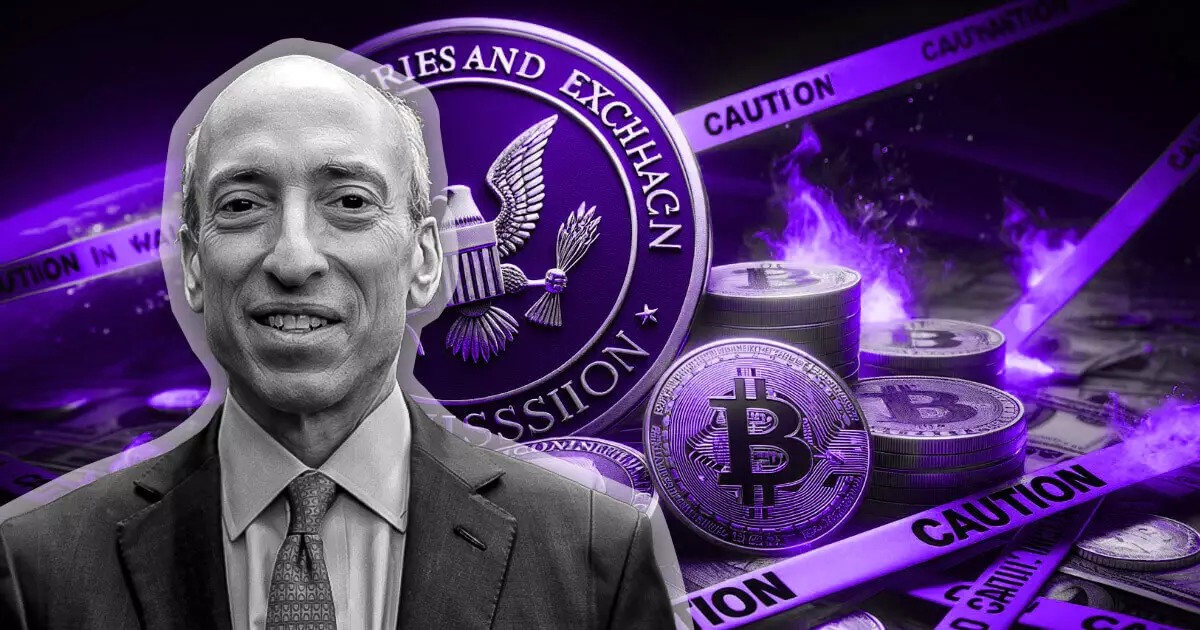

In a recent appearance on CNBC’s *Squawk Box*, SEC Chair Gary Gensler made it crystal clear that Bitcoin does not fall under the classification of a security. This statement is vital in the context of the ongoing regulatory examination of the cryptocurrency arena. Gensler’s affirmation that Bitcoin remains a commodity reflects a foundational distinction in U.S. law that has significant implications for investors and the market as a whole. The SEC has officially sanctioned various spot Bitcoin exchange-traded funds (ETFs), allowing for trading on major U.S. platforms like Nasdaq, thereby enhancing the accessibility of Bitcoin to a broader audience.

This clarification about Bitcoin is essential for encouraging market participation; however, Gensler did not shy away from criticism regarding the industry’s compliance with existing regulations. He pointed to a culture of non-compliance whereby numerous market participants are ignoring the laid-out rules. Gensler stated, “There are rules in place, but many have chosen to ignore them.” This observation raises questions about the potential risk this poses to investors and the market’s integrity, suggesting that without adherence to regulations, the echo of chaos lingers over the cryptocurrency landscape.

In stark contrast to Bitcoin’s designated status, Ethereum exists in a murky regulatory environment. With no clear classification from the SEC as either a security or a non-security, Ethereum-related projects hover under a cloud of uncertainty. While the SEC has approved ETF products tied to Ethereum, it simultaneously conducts investigations into significant players in the Ethereum ecosystem, creating a juxtaposition that may hinder the forward momentum of innovative projects. This duality illustrates a regulatory approach that lacks coherence, fostering confusion and apprehension among developers and investors.

Gensler’s methodology concerning Ethereum has sparked considerable criticism from various lawmakers, particularly those in the House of Representatives. Many argue that the SEC chairman’s loose definitions, such as referring to “crypto asset security,” exacerbate uncertainties in the market, stifling innovation and evolution. SEC commissioners, like Hester Peirce and Mark Uyeda, have echoed these concerns, emphasizing that the regulatory body has not leveraged its capacity to provide essential clarity.

Despite receiving pushback from different quarters, Gensler remains steadfast in advocating for a robust regulatory framework for cryptocurrencies. He believes that the long-term viability of the crypto sector hinges on establishing investor trust—an essential element for any functional market. Gensler’s analogy likening regulatory measures to “traffic lights and stop signs” illustrates his conviction that structured rules are crucial for preventing chaos and fostering a stable trading environment.

While Gensler’s resolute stance on Bitcoin delineates a straightforward path, the broader crypto market’s future remains precarious due to the inconsistent regulatory environment for assets like Ethereum. This dichotomy raises significant concerns about the trajectory of the industry, the safety of investors, and the potential for innovation. As the SEC navigates the challenge of regulation, the ultimate effectiveness of its approach will likely determine both the repute and resilience of the cryptocurrency landscape in the years to come.