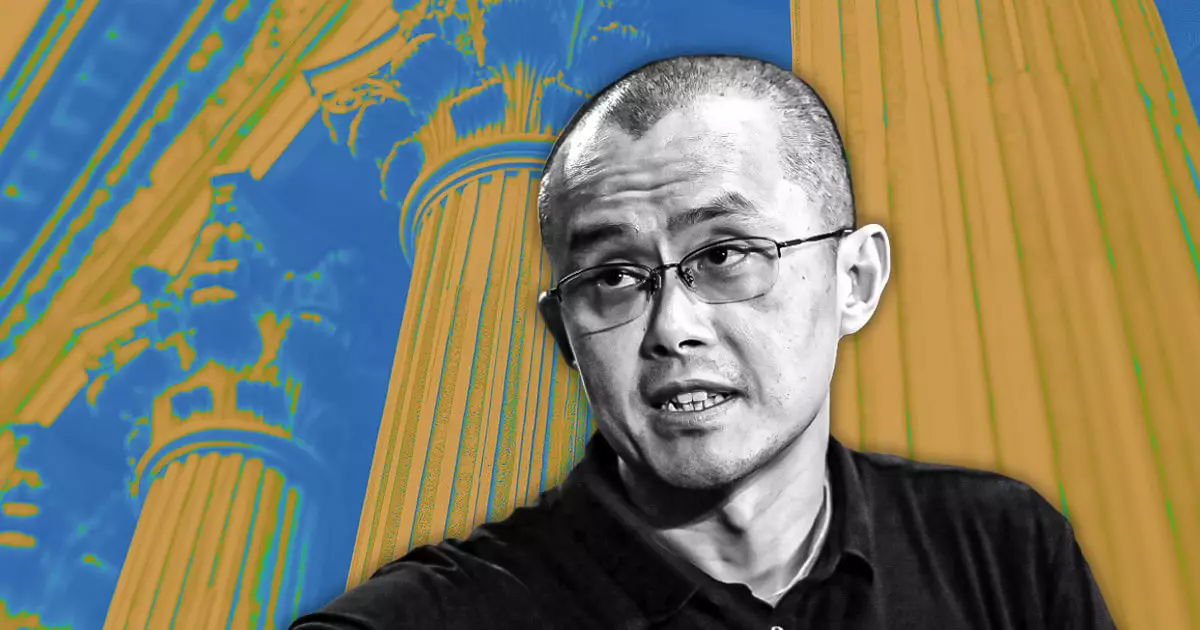

Recent statements from Changpeng Zhao, the founder and former CEO of Binance, have sought to quell rampant speculation regarding the future of the world’s premier cryptocurrency exchange. Following rumors that Binance was shopping for buyers or planning a major asset sell-off, CZ took to social media to dismiss these claims as mere misinformation propagated by competitors. He firmly denied any intention to completely sell the company, labeling the circulating rumors as disinformation from a “self-perceived competitor.” Yet, in a nuanced admission, he hinted that Binance may eventually explore the possibility of selling minority stakes to strategic investors.

Binance’s co-founder Yi He echoed this sentiment by spotlighting the perpetual interest from potential investors in the exchange. She emphasized that while the firm remains open to mergers and acquisitions, there are no immediate plans to dilute the current ownership structure. The idea of considering minority investments is not just a glance at future financing options; it represents a strategic alignment with trending market practices. In an industry where investment influx can provide added stability, a minority stake could introduce fresh capital without sacrificing operational autonomy.

Speculation intensified last week when sharp decreases in Binance’s crypto holdings were observed. To skeptics, this signaled potential asset liquidation, particularly concerning high-profile cryptocurrencies such as Bitcoin. However, Binance clarified that these reductions were a result of internal treasury accounting processes. The exchange assured users that all assets were still accounted for on a 1:1 backing basis, aiming to restore confidence concerning its financial viability. The market had responded with trepidation, exacerbated by a viral post on Chinese social media that alluded to regulatory hurdles and an upcoming sale.

Despite facing legal scrutiny and regulatory challenges, Binance continues to dominate the crypto exchange landscape, managing volumes in the billions daily. However, it is clear that pressures from competing platforms are intensifying, leading analysts to speculate that the consideration of minority investments may align with a strategy for fortifying Binance’s standing in a rapidly evolving market. Such a shift could forge pathways for institutional investment, granting them a foothold in one of the most influential exchanges worldwide.

Maintaining its historically private ownership structure, with CZ as a cornerstone stakeholder, Binance has primarily operated without external ownership influences. As the crypto ecosystem matures, it’s plausible that adopting a more open investment strategy could bolster financial resilience. By leveraging outside investment while preserving core operational independence, Binance may navigate the complexities of future market dynamics more adeptly. Therefore, the discussions surrounding minority stake sales serve as a reflection of not just Binance’s strategies, but also the broader implications for the entire cryptocurrency market.