In recent months, Bitcoin has become the focal point of financial media, especially as it surged past the $100,000 milestone in late December and early January, setting unprecedented records. The dramatic increase, however, was met with a perplexing sideways trading pattern that saw its value oscillate between $92,000 and $106,000. This period of relative stagnation lasted for about 75 days until it met a stark reversal, dropping below the psychologically significant threshold of $80,000. Such volatility is not uncommon in the cryptocurrency space, where the value of digital assets can change swiftly in response to market sentiment and external factors.

Bitcoin is now facing stiff headwinds, influenced by broader macroeconomic dynamics that have contributed to its decline. Recent weeks have witnessed a marked downturn across financial markets, with the NASDAQ Composite suffering a 3.5% decrease and gold futures following suit with a decline of 2.92%. This correlation indicates that Bitcoin does not exist in a vacuum; rather, it is tied intricately to fluctuations in traditional markets and the overarching economic climate. Moreover, the U.S. economy has experienced its first decline in consumer spending over a two-year stretch, signaling potential concern among consumers and investors alike.

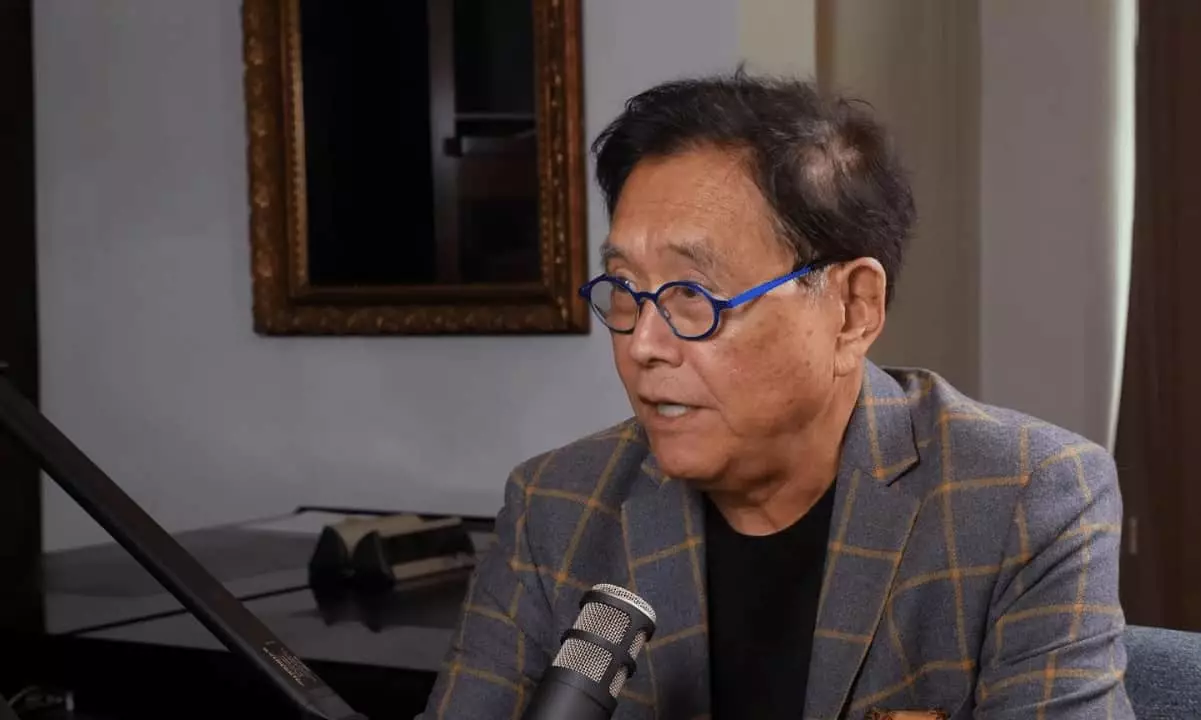

The sentiment in the crypto space has been further complicated by the actions of Bitcoin “whales,” or significant holders of the cryptocurrency, who have started to liquidate portions of their holdings. This has compounded the selling pressure in an already shaky market, with network activity and hash rates reflecting increased pessimism. Notably, these market movements have triggered speculation from both analysts and enthusiasts. Figures like Robert Kiyosaki have voiced optimism amidst the uncertainty, suggesting that the market may soon stabilize.

Hailing Bitcoin as a viable alternative to traditional financial systems, Kiyosaki’s assertions highlight an underlying belief that the inherent problems lie within the monetary system rather than the cryptocurrency itself. His criticisms of U.S. Treasury bonds and sweeping national debt emphasize a growing desire among investors for assets that offer value stability and autonomy from governmental policies.

As turmoil affects financial markets, recovery narratives have started to emerge, with certain analysts, like BitMEX founder Arthur Hayes, predicting further volatility that could ultimately lead to market stabilization. A recent surge in Bitcoin prices, bouncing back from lows of around $78,200 to exceed $86,000 by the following weekend, suggests a possible shift in investor sentiment. The increasing trade volume and a spike in phrases like “buy the dip” across social media platforms indicate a potential resurgence in bullish attitudes, further reflecting the resilient nature of the Bitcoin community.

Investors remain divided; while some expect greater downturns, others assert that the worst might be over, reinforcing the unpredictable nature of cryptocurrency investment. What remains clear is that, as macroeconomic conditions continue to affect investor psychology, Bitcoin will undoubtedly remain a touchstone for discussions on the future of money and investment strategies.