In an astonishing turn of events, the recent endorsement from Changpeng Zhao, the former CEO of Binance, has ignited a remarkable surge in the value of Travala’s AVA token. Over the past 24 hours, the AVA token has skyrocketed by more than 300%, a monumental leap fueled by a combination of strategic announcements and Zhao’s influential social media presence. Notably, Travala disclosed that its annual revenues hit an impressive $100 million in 2023, a substantial increase from $59.6 million, underlining the burgeoning interest in cryptocurrency payments for travel bookings, including flights and hotels.

The significant revenue achievement aligns with Travala’s new strategic direction, which involves retaining a portion of its funding reserves in AVA and Bitcoin—an approach reminiscent of MicroStrategy’s well-known investment strategy, championed by Michael Saylor. This commitment to hold crypto within its treasury not only signifies confidence in the digital asset space but also positions Travala as a forward-thinking player ready to capitalize on the growing intersection between cryptocurrency and travel.

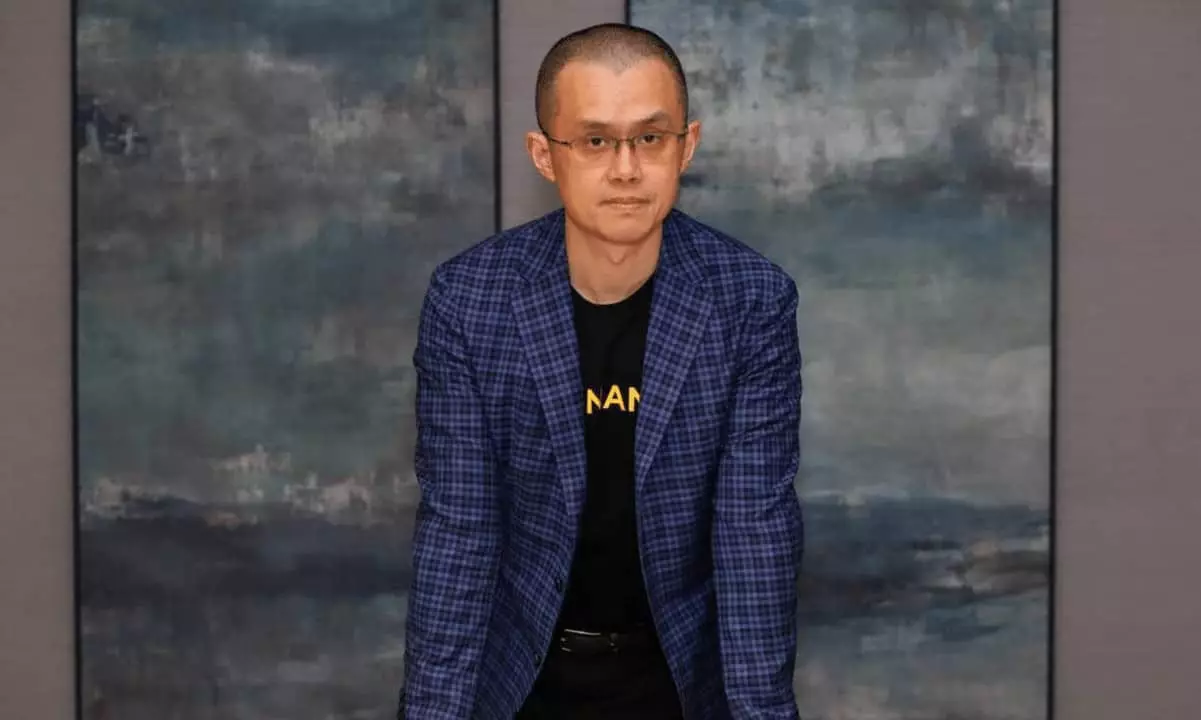

Zhao’s endorsement on social media, particularly through a post on X (formerly known as Twitter), effectively catalyzed a wave of interest in the AVA token. Citing Binance’s early investment in Travala, which took place before the onset of the COVID-19 pandemic, he amplified the platform’s credibility within the crypto community. As a recognized figure dubbed one of the “OGs of Crypto,” Zhao’s influence has systematically shaped market sentiments, pushing investors toward broader engagement with Travala.

The ripple effects of Zhao’s post were evident, with social engagement metrics on platforms like LunarCrush showing a dramatic uptick in AVA-related discussions. The views on Zhao’s post soared to over 1.3 million, suggesting that his words carried significant weight in driving market enthusiasm. This resulted in an explosive rally for the token, which surged from $0.75 to a peak of $3.38, although it settled at nearly 310% higher than its previous value within a day.

At the time of reporting, the AVA token boasted a substantial trading volume exceeding $890 million, highlighting a staggering 28,436% increase in trading activity. Against this backdrop, the crypto market at large has shown a decline of 2.20%, making AVA’s exceptional performance even more noteworthy. Furthermore, with a circulating supply of 56.3 million and a market valuation nearing $172 million, AVA has surged to #445 among cryptocurrencies by market cap, showcasing both its resilience and potential within a volatile market landscape.

The confluence of strategic initiatives by Travala, coupled with Zhao’s endorsements and the rising demand for cryptocurrency in travel, positions AVA for sustained growth. As the ecosystem evolves, the implications of such endorsements could significantly reshape investor perspectives on emerging crypto-driven platforms. Travala represents more than just a travel booking service; it may very well be a blueprint for the future of travel transactions in a rapidly digitizing economy.