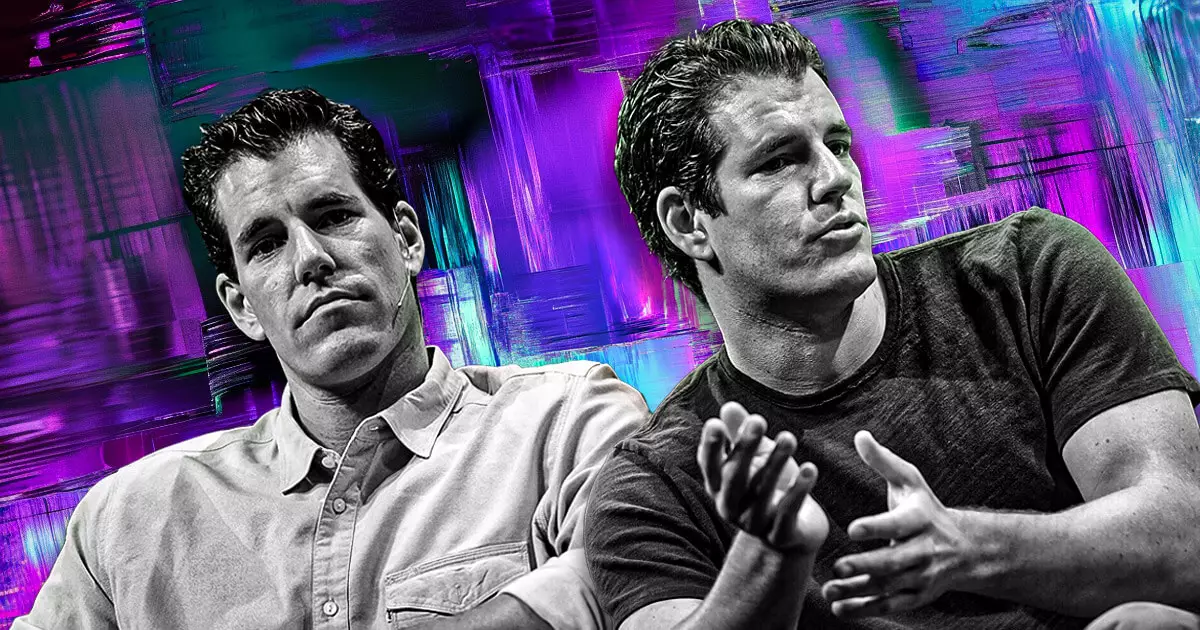

Gemini, the well-known cryptocurrency exchange founded by the Winklevoss twins, is reportedly contemplating an initial public offering (IPO) within the current year. This strategic move comes at a time when the landscape for cryptocurrency firms is evolving rapidly, with market participants cautiously optimistic due to potential regulatory easing. According to sources cited by Bloomberg News, discussions about a public listing have ensued, although no final decision has yet been revealed. This exploration aligns with a noticeable uptick in interest regarding IPOs among cryptocurrency entities, driven in part by the positive market sentiment stemming from the Trump administration’s seemingly favorable stance toward the crypto sector.

Political Influence on Market Trends

The growing interest in IPOs within the cryptocurrency industry can be partially attributed to political shifts. As highlighted by Bloomberg ETF analyst James Seyffart, the recent dynamics under the Trump administration suggest a supportive environment for cryptocurrency-related businesses. High-profile donations from the Winklevoss twins to Trump’s campaign have sparked conversation about the intertwining of politics and finance in the cryptocurrency realm. The implications of such support not only illustrate the growing connection between entrepreneurs and decision-makers, but they also indicate a potential future where regulatory frameworks may become more accommodating, fostering growth opportunities for crypto firms.

Challenges and Opportunities for Gemini

Despite these promising signals, Gemini has faced its share of obstacles. The exchange recently settled a lawsuit with the Commodity Futures Trading Commission (CFTC), which accused it of misleading regulators in its efforts to be the first entity to launch a regulated Bitcoin futures contract in the United States. This experience has been a wake-up call, marking a pivot for Gemini as it seeks to rebuild its reputation and establish a more robust compliance framework. Additionally, the exchange’s decision to withdraw from the Canadian market illustrates the broader regulatory challenges that many crypto companies are currently navigating.

Interestingly, while Gemini has pulled back from Canada, it has pursued opportunities abroad, particularly in Singapore. By securing a license to facilitate cross-border money transfers and digital payment token services, Gemini aims to capitalize on the city-state’s welcoming regulatory environment for cryptocurrencies. This strategic pivot reflects a broader trend within the industry as other notable firms like OKX and Coinbase have also expanded their operations in Singapore. Such moves underscore a crucial reality in the cryptocurrency landscape: adaptability is key.

With the cryptocurrency sector at a crossroads, Gemini’s potential IPO could set a precedent for other firms looking to go public. As the industry faces the dual challenges of regulatory scrutiny and market volatility, the next few years will likely see an increased number of crypto firms considering public listings. What remains certain is that the path forward will require careful navigation of regulations, market conditions, and political influences. In this evolving environment, Gemini stands as a testament to the resilience and ambition that defines the cryptocurrency industry today.