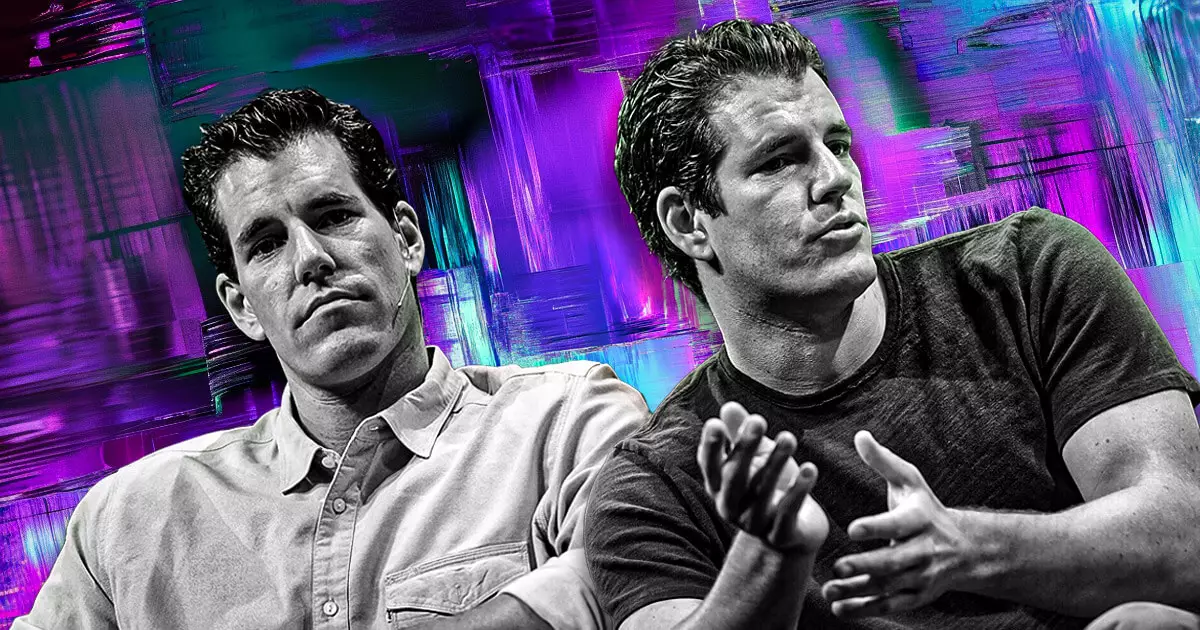

In a surprising move, Gemini, a significant player in the cryptocurrency exchange sector, has declared a ban on hiring graduates and interns from the Massachusetts Institute of Technology (MIT). This decision stemmed from MIT’s recent decision to reappoint Gary Gensler, the contentious former chair of the U.S. Securities and Exchange Commission (SEC), to a faculty position. Tyler Winklevoss, co-founder of Gemini, took to social media to express his discontent on January 29, stating categorically that as long as MIT maintains a connection with Gensler, their firm will not engage with its graduates, including for their internship programs.

This unprecedented stance reflects the widening rift between the crypto community and established regulatory figures, raising critical questions about the implications of educational and regulatory affiliations within the rapidly evolving cryptocurrency space.

The reappointment of Gensler at MIT has been met with sharp criticism from industry insiders. Cameron Winklevoss, the other co-founder of Gemini, condemned MIT’s decision, labeling Gensler an “expert in failed public policies.” This sentiment resonates with many in the crypto sector who view Gensler’s tenure at the SEC as a time of heightened scrutiny that stifled innovation in the rapidly developing realm of digital currencies. Gensler’s policies were often seen as overly harsh, making the approach of academic institutions that welcome such figures particularly contentious.

The backlash is illuminating a larger narrative about the growing tension between the crypto universe and traditional financial regulation, highlighting how one side feels increasingly marginalized by the other’s policy choices.

Gemini’s stance raises critical inquiries regarding the future relationships between cryptocurrency firms and academic institutions, particularly those that engage with regulatory authorities viewed unfavorably by the industry. The co-founder of Paradigm, Matt Huang, has encouraged professionals associated with MIT’s crypto programs to rally against the university’s decision, hinting at potential collective actions that could lead to broader ramifications across the industry.

Furthermore, concerns extend beyond mere hiring practices. Caitlin Long, CEO of Custodia Bank, has prompted reflection on whether this situation signals a shift wherein the cryptocurrency industry will increasingly distance itself from academic institutions that embrace figures like Gensler. The crypto community is no stranger to boycotts, having previously called for divestment from law firms that hire former regulators perceived to have acted against lawful innovation.

As these events unfold, they symbolize a critical crossroads for both the cryptocurrency industry and academic institutions. The growing sentiment among crypto advocates suggests that there is a diminishing tolerance for the affiliation of leaders like Gensler, whose regulatory approach is often viewed as antagonistic. This may lead to an environment ripe for significant changes in how universities engage with the entrepreneurial sectors, particularly in fields poised for disruption.

The decision by Gemini not to hire MIT graduates is a notable development in the ongoing dialogue about regulation and innovation in the crypto space. It serves as a clarion call for the industry to rethink its strategies and align more closely with entities that support rather than stifle technological advancement. The repercussions of this conflict could very well shape the landscape of the cryptocurrency industry and modify academic engagement in the years to come.