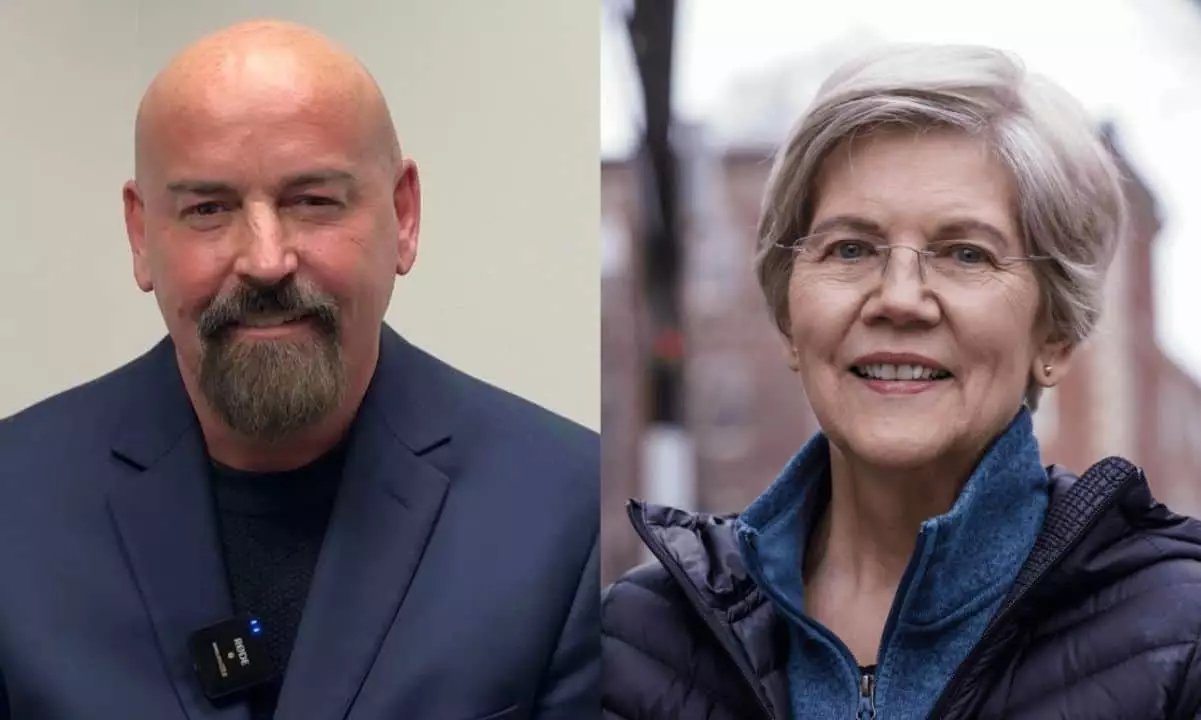

The recent debate between Senator Elizabeth Warren and John Deaton, a highly vocal advocate for cryptocurrency, marked a significant moment in the ongoing dialogue surrounding digital assets in the United States. The event highlighted not only contrasting viewpoints on crypto but also the wider implications for voters, regulators, and the future of financial freedom. As the dust settles from this passionate confrontation, it’s vital to dissect the arguments presented and understand their implications.

From the outset, the debate was characterized by an intense clash of ideologies. Senator Warren, known for her skepticism towards crypto, positioned herself as a guardian of consumer interests, while Deaton embraced the role of a defender of innovation and financial inclusivity. Warren’s assertion that Deaton could be a mere “mouthpiece” for the crypto industry if elected uncovers a deeper concern—whether policymakers can genuinely represent their constituents when deeply intertwined with specific industries.

Deaton, countering this narrative, passionately argued that cryptocurrency technologies can provide much-needed alternatives for populations traditionally underserved by conventional banking channels. He evoked a personal story about his mother’s struggles with banking fees, illustrating the potential of crypto to empower individuals rather than diminish their economic capabilities. This narrative not only humanized the issue but also positioned Deaton as a champion of the average citizen, contrasting starkly with Warren’s portrayal of crypto as a dangerous volatility generator.

The debate didn’t shy away from the pressing economic realities facing Americans today, particularly inflation and the cost of living. Deaton challenged Warren’s focus on crypto, jabbering that her commitment to combating inflation seems lackluster compared to her anti-crypto fervor. This rhetorical device was quite effective, framing Warren as neglectful of broader economic issues while fixating on the specifics of digital currencies.

This approach raised critical questions about priorities in governance—should lawmakers focus primarily on emerging technologies and possible risks, or address immediate economic concerns that affect everyday Americans in tangible ways? Deaton’s critique underlines a broader call for practical solutions rather than theoretical discussions.

A pivotal moment during the debate was Warren’s assertion that Deaton’s financial backing stemmed largely from the crypto sector, suggesting that his loyalty might lean more toward corporate interests rather than the people he aims to represent. This accusation reflects a significant and often contentious issue within political discourse—how financial influence can distort policy agendas.

Deaton’s retort brought a level of complexity to the discussion. He pointed out that Warren has also benefited from PACs and special interests, suggesting a hypocritical stance on campaign financing. The emphasis on financial motivations serves as a reminder of the intricacies involved in political campaigning and raises the question of how deeply legislators can remain committed to the public good when heavily funded by industry stakeholders.

As the debate drew to a close, the impact of regulations—or the lack thereof—on cryptocurrency became an undeniable focal point. Warren articulated her belief that while crypto has potential benefits, it must operate under stringent regulations akin to banks and credit unions. She noted concerns over illegal activities associated with digital currencies, such as money laundering and terrorist financing, positioning herself as a cautious proponent of consumer protections.

However, Deaton countered by arguing that Warren’s proposed policies essentially favor established financial institutions while stifling innovation. His critique points to a fundamental tension in regulatory discussions: the necessity of consumer safety against the backdrop of encouraging technological advancements.

The debate between Elizabeth Warren and John Deaton highlighted essential conflicts surrounding cryptocurrencies, including regulation, economic impacts, and the integrity of political representation. Each candidate brought compelling arguments to the table that underscore the delicate balance policymakers must strike between fostering innovation and safeguarding public interests.

As digital currencies continue to evolve, this debate serves as a microcosm of the larger conversation about the future of finance in America. It remains to be seen how the regulatory framework will unfold, and if lawmakers can bridge the gap between the democratization of finance and robust consumer protections. The outcome may define the next era of financial evolution and the role of governance in shaping those changes.