The cryptocurrency sector is no stranger to high-profile hacks, and the recent exploitation of Bybit has further highlighted the vulnerabilities present within even the most trusted digital wallets. With an estimated loss of nearly $1.5 billion, this breach has garnered significant attention not only for the scale of the theft but also for the technical details that led to it. At the heart of the controversy is a post-mortem report by Safe Wallet, which has received harsh criticism from former Binance CEO Changpeng Zhao (CZ).

Critical Reception of Safe Wallet’s Report

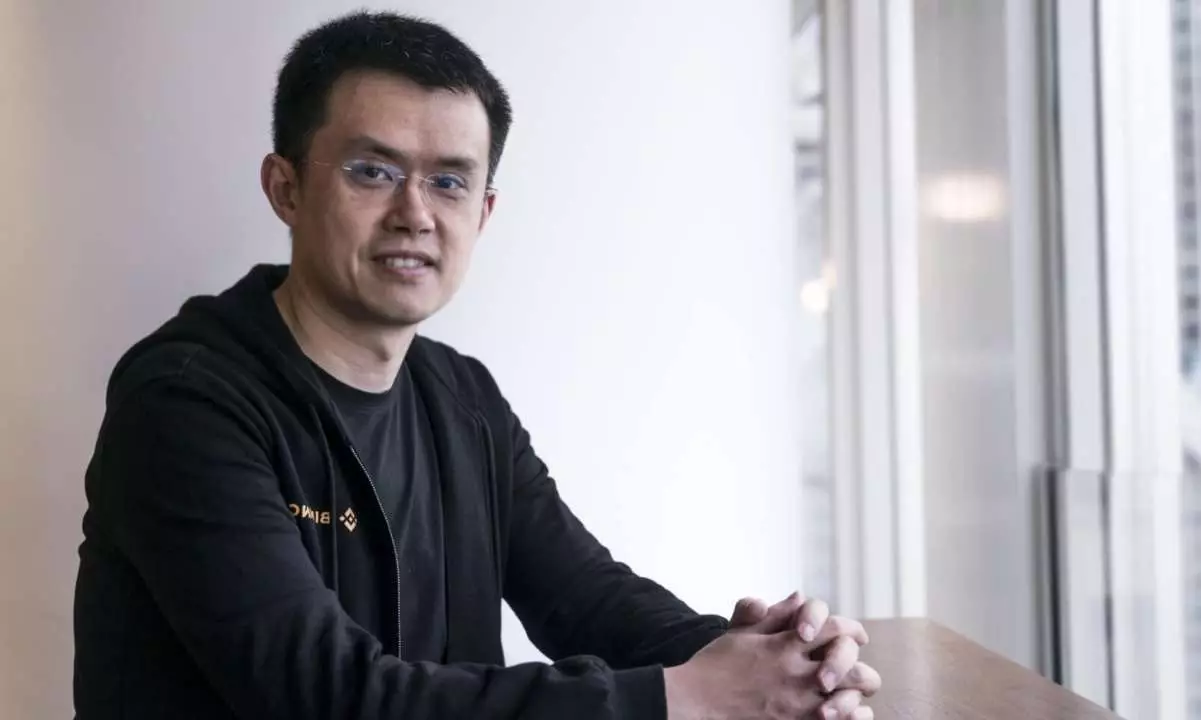

In a pointed statement, Changpeng Zhao referred to Safe Wallet’s updates on the hack as “not that great,” expressing his dissatisfaction with the vagueness of the language used. While Safe Wallet claimed that their infrastructure had been compromised rather than Bybit’s own systems, CZ raised important questions about the specifics of the breach. The fact that multiple signers were successfully deceived raises red flags; it suggests a systemic failure in safeguarding against malicious activities. CZ’s skepticism underscores a need for greater transparency and detail in crisis communications, especially when the stakes are as considerable as they are in this case.

An audit report released on February 26 sheds light on just how the exploitation occurred. According to investigators from Sygnia and Verichains, it was revealed that the attackers exploited compromised credentials from a Safe Wallet developer, which facilitated a series of deceptive transactions. This breach was accomplished through a well-crafted malicious JavaScript code that was injected into Safe’s Amazon Web Services (AWS) infrastructure two days prior to the hack. Such a sophisticated attack model underscores an evolving threat landscape within blockchain technology.

The successful exploitation relied on manipulating the wallet’s signing process. The report indicated that specific contract addresses were targeted, including Bybit’s multi-signature contract. This highlights not just vulnerabilities but also the advanced tactics employed by cybercriminals to make their attacks successful. The rapidity of the attackers, who were able to erase traces of their intrusion just two minutes after executing the hack, speaks to a high level of planning and technical skill.

In the wake of the breach, Bybit’s immediate response demonstrated a crucial need to manage client anxieties and restore confidence. They borrowed 40,000 ETH from Bitget to address withdrawal demands, ensuring that clients’ immediate concerns were met. Notably, Bybit also worked to secure its reserves through loans and other measures, amassing a total of 446,870 ETH, equivalent to around $1.23 billion. By doing so, the firm managed to recover its backing for client assets to 100%.

This response illustrates the complex interplay of reputation management and operational recovery following a breach. The situation places immense pressure on both the technical and managerial teams to not only secure the network but also uphold trust with users. Bybit has certainly shown an understanding of the importance of swift action in crisis management, yet the circumstances raise ongoing questions about long-term security in the crypto sector.

As the fallout from the Bybit hack continues to unfold, the discussions surrounding security best practices within the crypto ecosystem are becoming increasingly essential. The varying levels of security sophistication in wallets and exchanges, alongside the ever-evolving tactics of cybercriminals, make this an urgent task for all stakeholders. The probing questions raised by Changpeng Zhao exemplify the broader concerns resonating throughout the industry, pointing to the necessity for transparent reporting, enhanced infrastructure security, and the development of education initiatives focused on best practices. The Bybit hack serves as a sobering reminder of the vulnerabilities that persist in the blockchain space and the critical nature of continuous improvement in security measures to safeguard against future incidents.