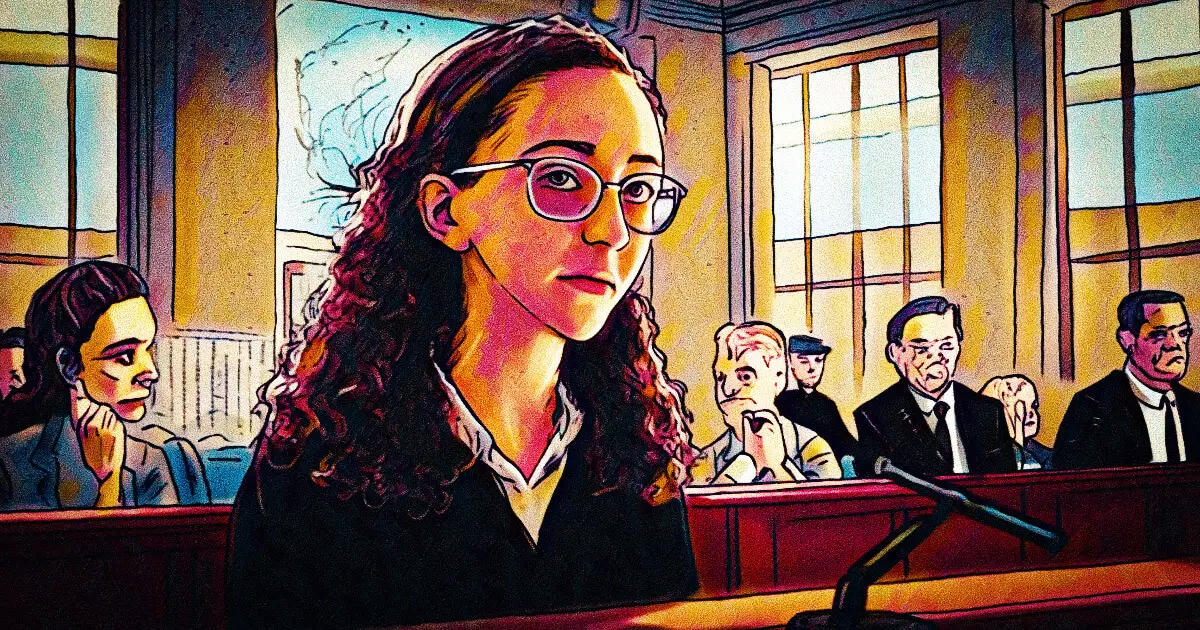

The collapse of FTX sent shockwaves through the cryptocurrency industry, and Caroline Ellison’s recent sentencing is a stark reminder of the legal repercussions faced by those involved. As the former CEO of Alameda Research and once intertwined with disgraced crypto mogul Sam Bankman-Fried (SBF), Ellison received a two-year prison term and was ordered to forfeit an astonishing $11 billion. This sentence, handed down on September 24, reflects the intricate layers and complexities of financial fraud in the digital asset realm.

Ellison’s defense team argued against her incarceration by highlighting her cooperation with federal investigators and her pivotal testimony during SBF’s trial, which resulted in his 25-year sentence for multiple fraud charges. They claimed that her contributions were vital in elucidating the financial mismanagement within both FTX and Alameda Research, facilitating the recovery of substantial assets. It raises the question: does cooperation truly mitigate culpability in the world of corporate crime, especially when it involves vast amounts of misappropriated funds?

Ellison’s case emphasizes the importance of the human element in financial decisions that lead to catastrophic outcomes. Her legal counsel pointed to her previously unblemished record as they argued for a reduced sentence. They portrayed her as a victim of SBF’s “manipulative behavior,” suggesting that her moral compass was skewed by a toxic mix of personal and professional entanglements. This narrative complicates the perception of accountability—can we hold individuals fully responsible when they are caught in such high-stakes scenarios?

In December 2022, Ellison accepted a plea deal soon after FTX’s bankruptcy filing and subsequently testified for nearly three days during SBF’s trial. Her testimony was described as the “cornerstone” of the prosecution’s case, illustrating the extensive operations and mismanagement at both FTX and Alameda Research. This brings to light the challenging nature of whistleblowing in corporate environments, where individuals often weigh the consequences of exposing wrongdoing against their self-preservation.

The implications of Ellison’s sentencing extend beyond her individual case; they spotlit the urgent need for enhanced regulatory measures in the cryptocurrency sector. Once celebrated for its innovation, FTX’s downfall demonstrates the vulnerabilities inherent in a largely unregulated environment. As major executives face legal ramifications, the stakes are raised for future market participants and regulators alike. The trends in the legal proceedings against former FTX executives, such as Ryan Salame’s seven-and-a-half-year prison sentence, underscore the shift towards accountability.

Moreover, the narrative surrounding cryptocurrency has been reshaped significantly. With FTX being a leading player before its implosion, the need for robust oversight has become apparent. As the digital economy continues to evolve, the legal precedents established through these cases will likely influence how authorities approach regulation and enforcement in the rapidly changing financial landscape.

Caroline Ellison’s sentencing is not just about her individual actions but rather a reflection of the broader systemic failures in the cryptocurrency industry. As the legal saga continues, the community watches closely, waiting to see how these events will shape the future of crypto regulation and investor protection.