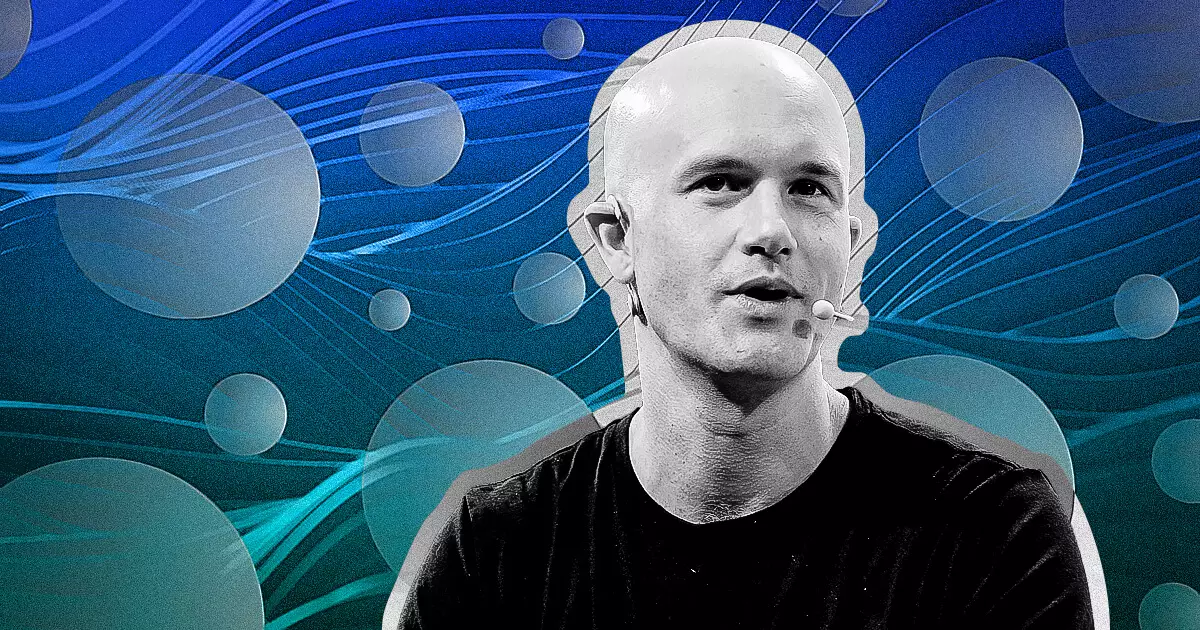

The cryptocurrency market has witnessed an unprecedented transformation over the last few years, with the advent of numerous new tokens resulting from blockchain innovation. As traditional methods of asset evaluation struggle to keep pace with this rapid expansion, industry leaders are beginning to voice concerns. Brian Armstrong, the CEO of Coinbase, recently took to social media to advocate for a significant overhaul of the token listing process. His remarks underscore a broader issue: the tension between the explosive growth of digital assets and the outdated mechanisms currently in place to evaluate them.

As cryptocurrencies gain traction, the influx of new tokens created each week has reached staggering numbers, with estimates indicating as many as one million new creations. This phenomenon has overwhelmed existing evaluation systems which typically rely on centralized approval processes. Armstrong’s assertion that “evaluating each one by one is no longer feasible” captures the essence of the challenge facing the industry.

The rise of no-code blockchain solutions and token generation tools has empowered individuals without technical expertise to launch their own digital assets effortlessly. While this democratization fosters innovation, it also creates a chaotic environment filled with an abundance of tokens, many of which lack fundamental security or utility. Analysts have pointed out that this surge necessitates a fundamental rethink of existing frameworks, particularly as regulatory bodies are often ill-equipped to handle such rapid transformations.

Armstrong’s proposal for a block-list system represents a potential solution to this urgent issue. By shifting the focus from an approval process to a reactive model wherein tokens are presumed legitimate unless flagged for harmful activity, the industry can adapt to its current realities. This method not only streamlines the listing process but also significantly reduces bottlenecks created by the need for centralized approval.

Through his comments, Armstrong highlighted the importance of user empowerment in the evolving crypto landscape. By advocating for a system that relies on community feedback and automated data scans, Armstrong envisions a more scalable and secure ecosystem. This approach would allow for greater transparency, as users would assist in identifying potential risks associated with new tokens.

Moreover, the call for regulatory innovation is equally crucial. Armstrong emphasized that existing frameworks are insufficient for today’s pace of technological advancement. He urged regulators to adapt their practices and collaborate with industry stakeholders. Such partnerships could yield new standards that protect investors while promoting the growth and innovation that define the crypto sector.

Building on his vision for enhanced token evaluation, Armstrong reiterated Coinbase’s commitment to integrating decentralized exchange (DEX) functionalities into its platform. This strategic move aims to create a unified trading experience that seamlessly blends centralized and decentralized options, thereby making it simpler for users to interact with the vast blockchain ecosystem.

The implications of this strategy are significant. As one of the largest cryptocurrency exchanges in the world, Coinbase possesses the ability to shape market dynamics and set a precedent for other players in the industry. Armstrong’s aim to eliminate barriers between centralized and decentralized trading options indicates an unwavering belief in the potential for a more inclusive and user-friendly cryptocurrency environment.

Brian Armstrong’s advocacy for reforming the token listing process is a clarion call for change, reflecting the necessity for the industry to adapt to a rapidly evolving landscape. His comments resonate with many who recognize that outdated systems cannot effectively manage the current pace of innovation in cryptocurrencies. The onus now lies on regulators, industry leaders, and blockchain developers to embrace collaborative efforts for a sustainable future.

As Coinbase pioneers initiatives to redefine access to decentralized trading while advocating for improved oversight, the industry stands at a crossroads. The fusion of user feedback, innovation in regulatory frameworks, and the integration of DEX functions into mainstream platforms may well determine the future trajectory of cryptocurrency as an accessible and reliable asset class. Armstrong’s vision, if realized, could pave the way for a more efficient, transparent, and empowered cryptocurrency ecosystem.