Christopher Giancarlo, the former Chair of the Commodity Futures Trading Commission (CFTC), recently found himself in the spotlight as rumors circulated about his potential candidacy for the next Chair of the US Securities and Exchange Commission (SEC). In a clear dismissal, Giancarlo denied these speculations and expressed a disinterest in any crypto-related position within the US Treasury Department. He underscored his sentiment by indicating that he had already navigated the challenges posed by his predecessor, Gary Gensler, and had no desire to engage in similar turmoil again. This rejection not only clarifies Giancarlo’s current professional direction but also reflects a growing frustration with the existing regulatory landscape in the US.

The ambiguity surrounding Giancarlo’s reference to the ‘mess’ left by Gensler raises pertinent questions about the SEC’s regulatory approach towards the rapidly evolving cryptocurrency landscape. Gensler has been a polarizing figure in the crypto community, particularly because of his administration’s reliance on a “regulation by enforcement” strategy. This method, which has been criticized by various industry stakeholders, leads to increased uncertainty about compliance and the overall regulatory framework within which crypto entities must operate. One SEC Commissioner went as far as to label this approach a “disaster,” highlighting a crucial divide between regulatory intentions and industry realities.

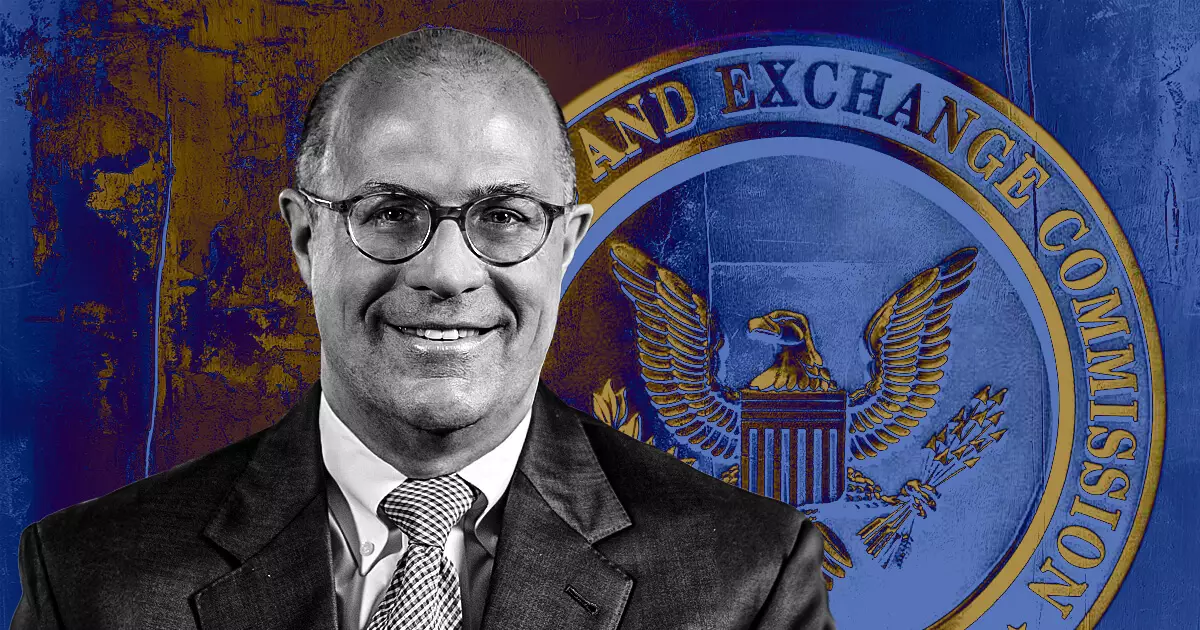

Known as ‘Crypto Dad’ for his pro-cryptocurrency stance, Giancarlo has advocated for clarity and support for the crypto industry. His tenure at the CFTC saw him championing the legitimacy of digital currencies, especially after he famously stated in 2018 that “cryptocurrencies are here to stay.” His subsequent autobiography published in 2021 reinforced his supportive views on the sector, indicating a commitment to fostering an environment conducive to innovation. Currently advising the US Digital Chamber of Commerce, he remains a formidable voice in discussions surrounding cryptocurrency regulation and its implications for the future.

Contrasting sharply with Giancarlo’s approach, Gensler has publicly defended the SEC’s rigorous enforcement strategies. During a recent conference, he articulated a framework whereby while Bitcoin might not fit the criteria of a security, many alternative digital assets do. This classification underlines the urgency for regulatory compliance from digital asset sellers and intermediaries to protect investors. Gensler’s emphasis on preventing “significant investor harm” illustrates his commitment to safeguarding market integrity, though many argue that his strategies may stifle innovation within the crypto sector.

Since Gensler took charge in 2021, the SEC has pursued aggressive legal actions against numerous crypto firms, including industry giants like Kraken and Binance, sparking significant backlash. Critics from within the crypto community and the financial sector argue that such heavy-handed enforcement does not create an environment conducive to growth and innovation. This creates a challenging dynamic, as the need for regulatory oversight must be balanced with the need for the industry to flourish without suffocating constraints.

The discourse surrounding regulatory approaches to cryptocurrency remains contentious. Giancarlo’s refusal to step back into regulatory troubled waters emphasizes the complexity faced by industry leaders. As conversations evolve, the relationship between regulatory bodies and cryptocurrency platforms will undoubtedly shape the future of financial innovation in the United States.