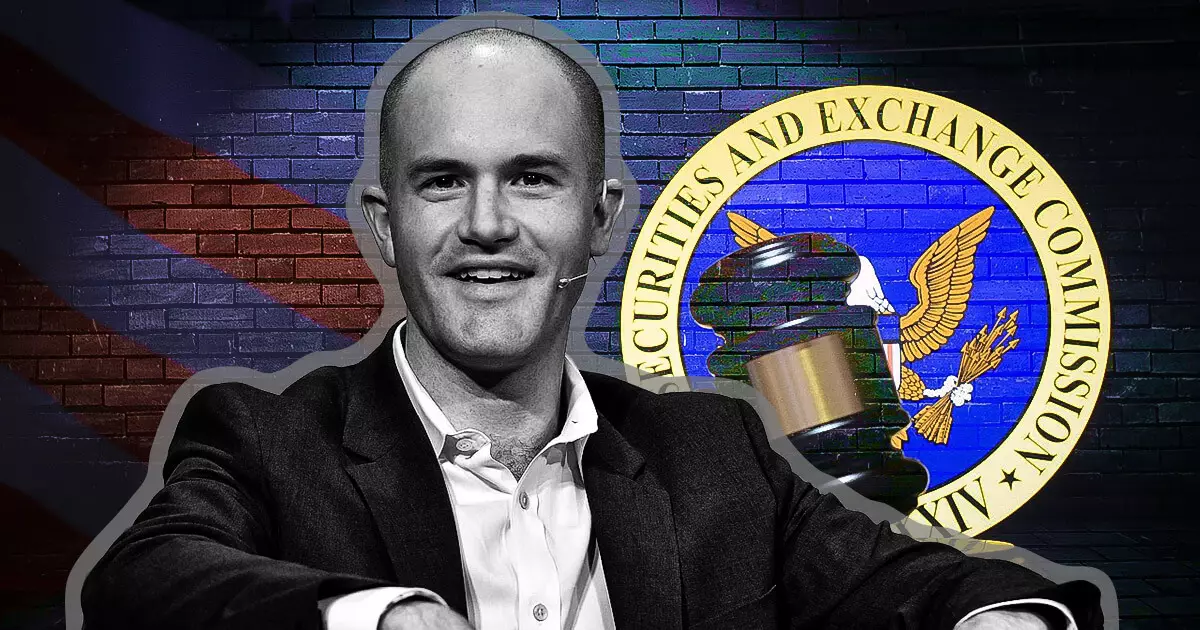

In a bold and controversial move, Coinbase CEO Brian Armstrong recently announced a decision to cut ties with law firms employing former regulatory figures, whom he accuses of engaging in unethical practices harmful to the cryptocurrency sector. Armstrong’s decree, revealed through a social media statement, signals a critical juncture for the cryptocurrency exchange that has often found itself at odds with regulatory authorities. The catalyst for this announcement appears to be the hiring of ex-SEC Division of Enforcement Director Gurbir S. Grewal by Milbank’s Litigation & Arbitration Group. Armstrong’s assertion that such hires will result in a loss of business from Coinbase indicates a fired-up sentiment amongst crypto proponents disenchanted with the prevailing regulatory landscape.

The crux of Armstrong’s argument lies in his interpretation of ethical conduct in the regulatory environment. He condemns certain former regulatory officials for their roles during the previous administration, claiming they contributed to bouts of hostility against the cryptocurrency industry without offering adequate guidance on compliance. This perspective poses significant questions regarding accountability within regulatory agencies. Armstrong’s comments suggest that individuals in prominent positions should not merely act as puppets but must uphold a moral responsibility to the sectors they oversee. By branding Grewal’s actions as an “ethics violation,” Armstrong amplifies the ongoing debate surrounding regulatory overreach and the consequences for fintech innovation.

Armstrong’s reaction stems from a broader frustration within the cryptocurrency community, which has long been calling for definitive guidelines from the Securities and Exchange Commission (SEC). His assertion that the previous SEC administration deliberately targeted crypto firms, particularly during a boom in innovation, showcases a rift that continues to widen. This sentiment connects to a larger narrative where the SEC’s approach has been seen as reactionary rather than proactive, leaving companies in a perpetual state of uncertainty regarding compliance. In outlining his position, Armstrong articulates a crucial need for industry stakeholders to advocate for transparency and clearer frameworks to enable innovation rather than stifle it.

Interestingly, Armstrong expresses reluctance to engage in “permanently canceling people,” indicating a desire for transformative accountability rather than outright ostracism. This nuanced stance reveals a potential pathway for reconciling the interests of both the cryptocurrency industry and the regulatory bodies. By urging law firms to reconsider their associations with individuals he deems culpable, Armstrong’s strategy seeks not only to distance Coinbase from perceived unethical affiliations but also to cultivate a more principled industry environment—a call for conscientious partnership in an evolving regulatory landscape.

Ultimately, this statement from the Coinbase CEO underscores the significant tension existing between the cryptocurrency sector and regulatory agencies, epitomized by Armstrong’s critique of individuals like Grewal. As the cryptocurrency industry faces continuous pressure from regulatory bodies, stakeholders must navigate a landscape fraught with uncertainty. Armstrong’s clarion call may resonate deeply within the crypto community, serving as a rallying point for advocacy regarding ethical conduct and the necessity of constructive dialogue between the industry and its regulators. In an era marked by rapid technological advancement, the outcome of this standoff may redefine the regulatory framework for digital assets in years to come.