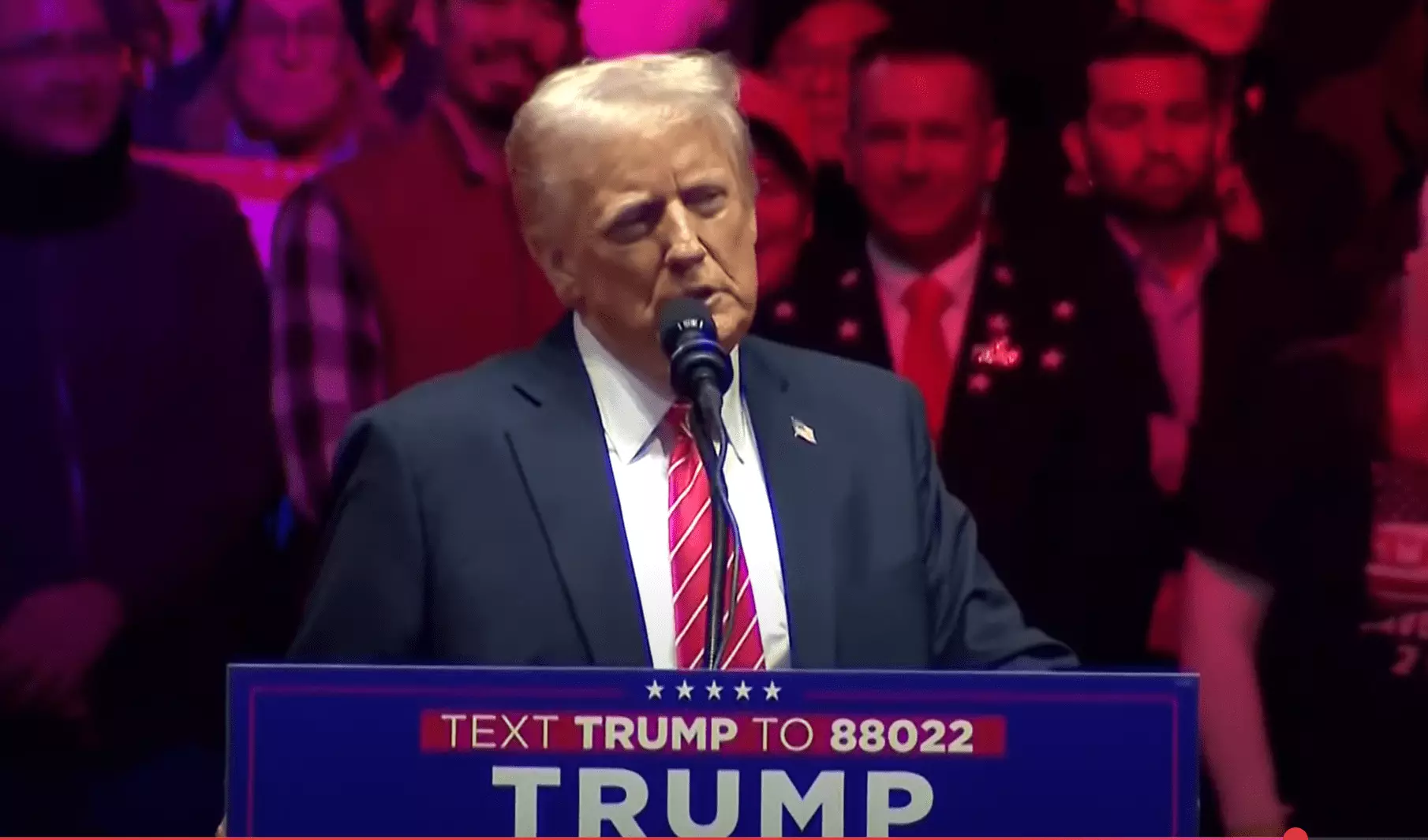

Bitcoin has climbed the ladder to a jaw-dropping all-time high of $109,558, coinciding intriguingly with President Donald Trump’s inauguration day. This surge in value has been accompanied by rampant speculation about the possibility of the Trump administration establishing a Strategic Bitcoin Reserve (SBR) via an executive order. While the idea of a US Bitcoin reserve has been on the table for several months, a sudden uptick in speculative betting on its emergence, particularly through platforms like Polymarket, has sent ripples through the crypto community, suggesting that something significant may be on the horizon.

The cryptocurrency market thrives on speculation, and nothing amplifies this atmosphere quite like shifts in political landscapes. Observers note that the odds of Trump forming a Strategic Bitcoin Reserve surged to 59% shortly before Bitcoin experienced its meteoric price increase. The potential for an executive order establishing a reserve, rumored to be signed imminently, has incited a frenzied interest among traders and investors alike. Although previous electoral promises from Trump suggested transferring seized Bitcoin into a government-hold initiative, the recent buzz has taken that conversation to new heights—or lows, depending on one’s perspective.

This speculation gained traction partly due to the closed-door meetings that several prominent Bitcoin advocates held with Trump’s team over the weekend. Conversations between key senators known for their pro-Bitcoin positions, like Senators John Barrasso and Cynthia Lummis, fostered a sense of legitimacy around these rumors. Lummis has actively championed legislation conducive to Bitcoin and cryptocurrency adoption, fuelling both conversation and uncertainty in the digital currency markets. Her commitment to establishing a comprehensive digital asset framework has created a compelling nexus of interest between Washington and Silicon Valley for crypto enthusiasts.

High-profile engagements between Trump’s administration and leading Bitcoin advocates serve a dual purpose: on one hand, they suggest a potential legitimization of cryptocurrencies at the federal level, and on the other, they create market volatility that can sway individual and institutional investments. Key figures from the crypto industry, including MicroStrategy Chairman Michael Saylor and various CEOs, have openly vocalized their support for a pro-Bitcoin agenda, and their participation in dialogues with the new administration indicates a concerted effort to bridge the gap between traditional finance and digital currencies.

The prospect of a Strategic Bitcoin Reserve not only stirs enthusiasm among advocates but also raises profound questions about the future trajectory of financial markets. If the government were to hold Bitcoin as a reserve asset, the implications for both traditional currency systems and cryptocurrencies could be monumental. It would also position the US as a pioneer in the evolving landscape of digital asset regulations, echoing sentiments expressed by Bitcoin’s staunch supporters.

The immediate market reactions to the potential establishment of a Strategic Bitcoin Reserve have been enthusiastic yet cautious. Market analysts like Charles Edwards have noted that swift movements in Bitcoin’s price can signify underlying shifts in investor sentiment. Following significant price moves—both upward and downward—there tends to be a recalibration among investors who recognize the ‘real moves’ that inform new trends in such volatile markets.

At the crux of this conversation lies the inherent volatility of the cryptocurrency landscape. Prices can shift dramatically based on factors that may be unrelated to underlying economic fundamentals. This creates a scenario wherein Bitcoin investors must tread carefully. While the potential for a government-backed reserve has sparked speculation and price spikes, the unpredictable nature of cryptocurrencies remains at the forefront of any discussion regarding investment.

As BTC stands at an impressive $108,182 at the time of writing, it’s clear that the intersection of politics and cryptocurrency is more relevant than ever. The potential for a Strategic Bitcoin Reserve could herald a new era for Bitcoin, redefining its value proposition in the process. However, it is essential to approach these developments with a critical eye, recognizing that speculation, volatility, and rapid price changes are hallmarks of this burgeoning asset class.

In the coming days, weeks, and months, as Trump’s administration potentially reacts to pressing matters of governance, Bitcoin’s fate may very well hang in the balance. While the idea of a Strategic Bitcoin Reserve excites many, the broader implications for the financial landscape and individual investors warrant serious contemplation as the cryptocurrency saga continues to unfold.