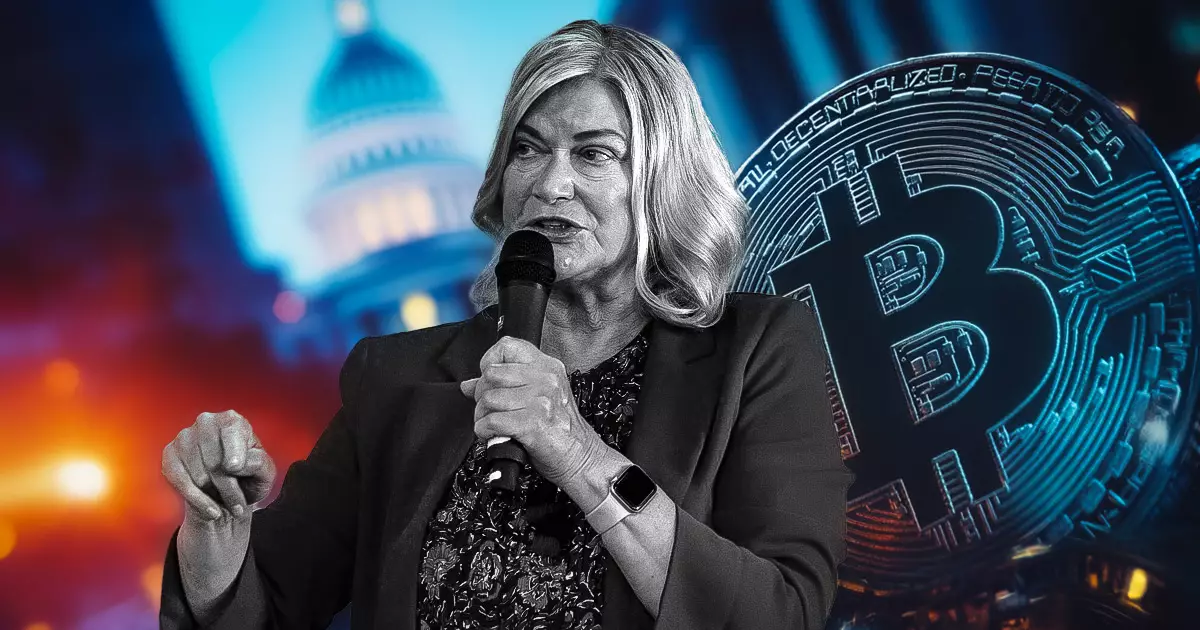

The United States Senate recently welcomed a significant development in the realm of digital finance with the appointment of Senator Cynthia Lummis (R-Wyo.) as the inaugural chair of the newly created Senate Banking Subcommittee on Digital Assets. This momentous decision, announced on January 23, signals a continuing transition towards integrating cryptocurrency regulation within the broader financial system of the nation. Under the aegis of Senate Banking Committee Chair Tim Scott (R-S.C.), Lummis’s leadership opens the door to urgent legislative initiatives that promise to shape the regulatory landscape for blockchain technologies and cryptocurrencies in the U.S.

Senator Lummis, an ardent proponent of Bitcoin, is enthusiastic about her new role, which she believes is pivotal to ensure that the U.S. retains its status as a global leader in financial innovation. She contends that the country must act swiftly to establish a bipartisan legal framework that encompasses digital assets. Lummis expressed her vision, stating, “Digital assets are the future,” highlighting the pressing need for legislation that provides clarity and security for this burgeoning market. Her foresight includes the ambitious proposal for a national Bitcoin reserve to strengthen the U.S. dollar, marking an innovative strategy that could position the nation at the forefront of cryptocurrency adoption.

The subcommittee led by Lummis is primed to prioritize legislation that addresses multiple facets of the digital asset ecosystem, including market structure, stablecoins, and consumer protections. The collaborative nature of the subcommittee is profound, featuring a balanced mix of both Republican and Democratic members. By bringing together figures like Senators Thom Tillis (R-N.C.) and Ruben Gallego (D-Ariz.), the committee underscores its commitment to bipartisan cooperation. This collaborative spirit is essential, as it may help mitigate regulatory challenges while nurturing innovation within the United States.

Responses from the cryptocurrency industry reveal a growing optimism about Lummis’s appointment. Many stakeholders see it as a historic opportunity to advance significant legislative agendas, including the proposed Strategic Bitcoin Reserve. As noted by Dennis Porter, co-founder and CEO of Satoshi Action Fund, Lummis’s appointment represents “a huge step forward” for the prospects of meaningful legislation in the crypto space. Additionally, comments from former Binance CEO Changpeng Zhao deem the idea of a U.S. Bitcoin reserve as “pretty much confirmed,” illustrating the rapid pace at which developments in the digital asset sector are unfolding.

As the U.S. moves toward establishing a regulatory structure for digital assets, the importance of Lummis’s role cannot be understated. Her leadership may serve as a catalyst for establishing a regulatory environment that supports innovation while safeguarding consumers. By prioritizing the creation of a robust framework, the subcommittee has the potential not only to stimulate economic growth within the U.S. but also to establish a path that other countries might seek to emulate. The upcoming legislative actions will be closely watched, as they have the power to greatly influence both the domestic and global landscape of digital finance.