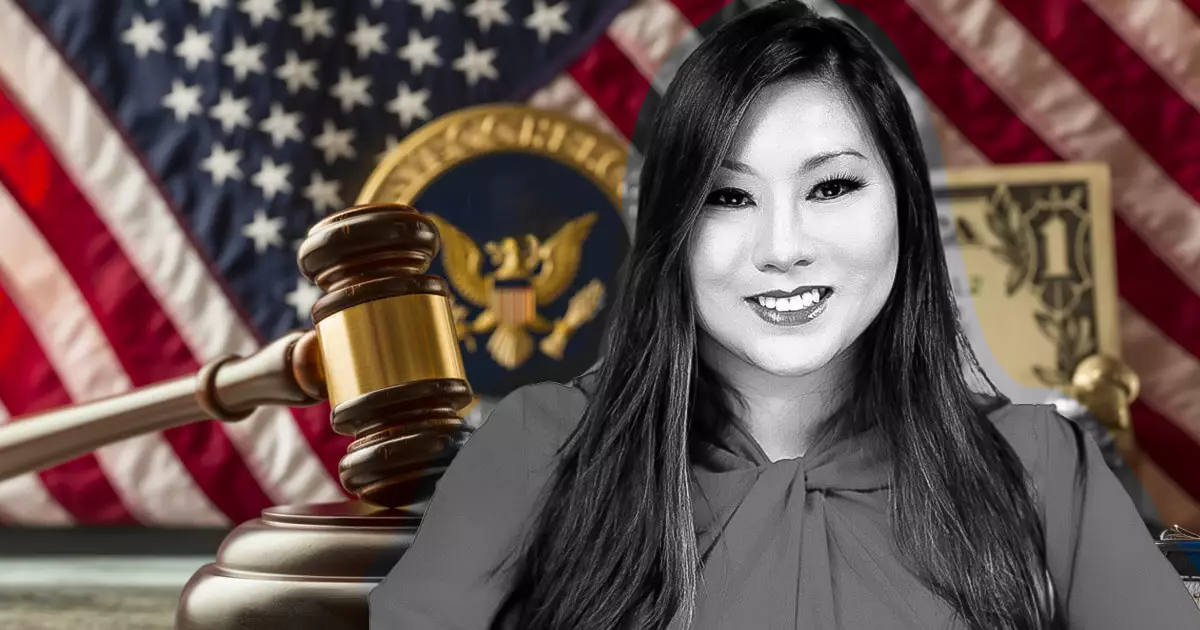

The recent appointment of Caroline Pham as the acting chair of the Commodity Futures Trading Commission (CFTC) marks a significant development in the regulatory landscape surrounding cryptocurrency in the United States. Her selection comes amid the ongoing transition of leadership within federal agencies, particularly as the Biden administration continues to shape its regulatory priorities. While Pham’s appointment is rooted in traditional practices—commissioners typically backing the new administration’s nominees—it also signals a potential shift towards more proactive and innovative regulatory frameworks.

Caroline Pham has been a junior commissioner at the CFTC since her appointment in 2021 by former President Joe Biden. Throughout her tenure, she has established herself as a formidable advocate for clarity in regulatory processes pertaining to the digital asset sector. Pham’s push for “regulatory sandboxes” exemplifies her commitment to developing a conducive environment for innovation in cryptocurrency. This concept allows companies to experiment with their offerings under regulatory oversight without the immediate burden of exhaustive compliance, balancing safety with the need for technological advancement.

In a notable speech at the Cato Institute, Pham outlined her vision for a government-led pilot program aimed at nurturing compliant digital asset markets. Her approach emphasizes collaboration between regulators and industry players, advocating for a comprehensive set of guidelines that can drive risk management and enhance transparency. This program seeks to tackle the pervasive dangers of fraud and mismanagement that have plagued the crypto market, aiming to create a more robust and trustworthy environment. Such initiatives are crucial not only for maintaining market integrity but also for reassuring investors and nurturing public confidence in the digital asset sector.

In her discussions, Pham has drawn attention to a pressing concern: the United States risks losing its competitive edge in the global cryptocurrency arena if it fails to adopt coherent and forward-thinking regulations. With many international jurisdictions advancing their own strategic policies to accommodate and regulate crypto assets, it’s essential for the U.S. to keep pace. Pham’s emphasis on the need for the U.S. to develop long-term strategies for cryptocurrency governance is not merely a matter of regulatory tidiness; it’s a call to ensure that American innovation remains at the forefront.

As the acting chair of the CFTC, Caroline Pham has the opportunity to influence the future of crypto regulation significantly. Her commitment to fostering innovation while implementing stringent regulatory measures could pave the way for a balanced relationship between market growth and consumer protection. The challenges ahead are considerable, but with a clear focus on collaboration and strategic foresight, Pham’s leadership may well be instrumental in shaping a resilient infrastructure for cryptocurrency in the United States, ensuring it not only catches up with international standards but leads in the rapidly evolving digital finance landscape.