Ethereum has recently experienced a surge that can only be described as breathtaking; a rapid increase that sent many investors into a frenzy, pushing the price past crucial benchmarks. Just a week ago, ETH was scraping against the ceiling of $2,740, a level that now appears to be a formidable obstacle. It managed to break through significant milestones at $2,000 and $2,200, signaling a robust momentum not seen in months. As an observer of market dynamics, it’s hard not to marvel at the exhilarating heights Ethereum has scaled, even as this recent pause raises important questions about its sustainability.

The immediate challenge is whether this pause is a sign of healthy consolidation or a precursor to deeper corrections. When prices rally so quickly, a backlash isn’t just expected; it’s often necessary. Analysts speculate this moment may serve as a critical pivot point that dictates Ethereum’s future trajectory. If history teaches us anything, it’s that despair can often loom after euphoria, and investors must tread with caution.

The Critical Support Levels

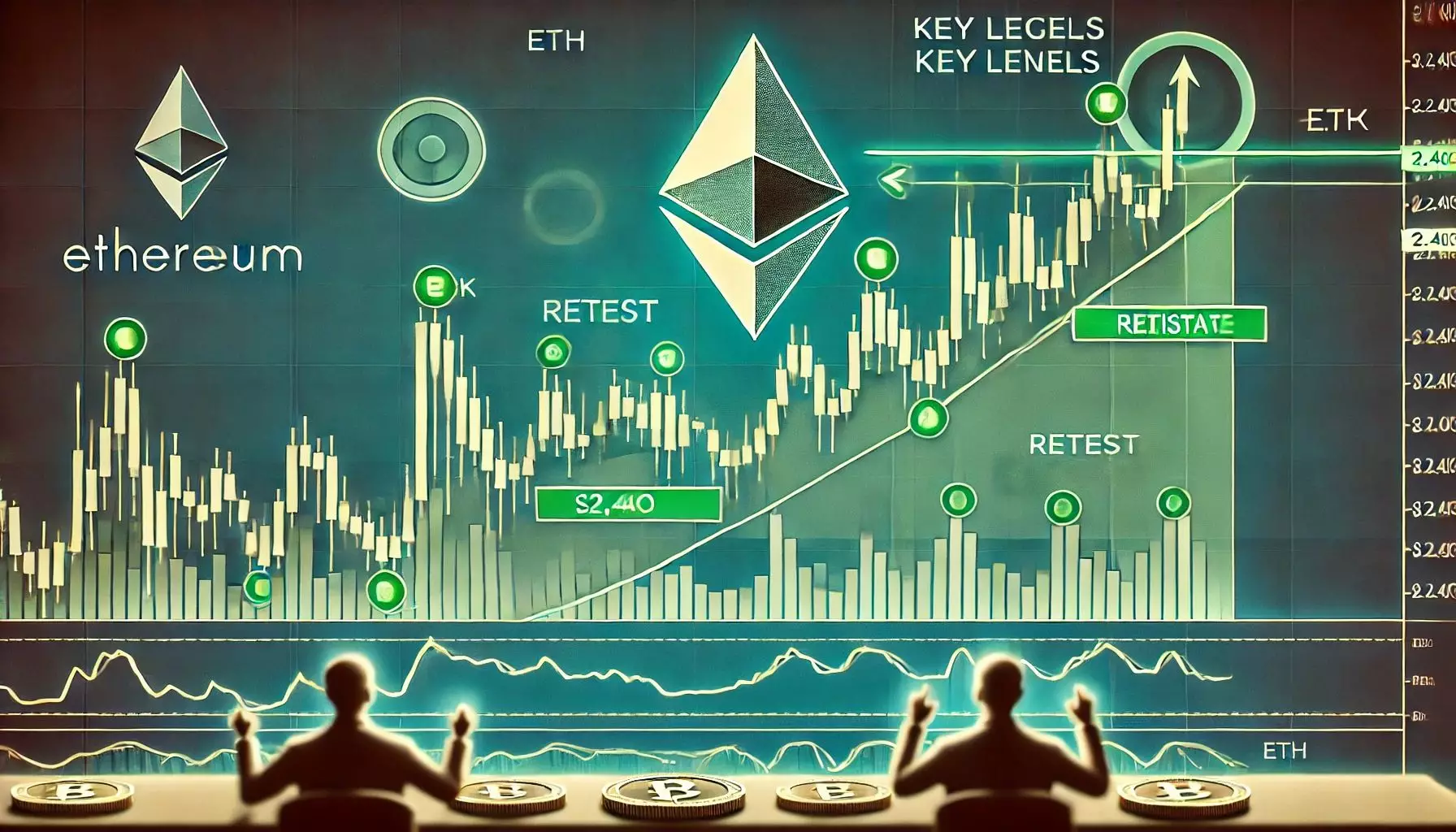

Daan, a notable analyst in the crypto space, emphasizes the significance of the $2,400 support level, arguing it might serve as a new battlefield for bullish convictions. It’s nearly poetic how a numerical value can embody such weight in traders’ psyches. If the bulls don’t defend this crucial level, the doors could swing wide open for a quick descent toward the $2,100 mark. The stakes have never been higher; a failure to hold this ground could signify a major shift in market sentiment.

What lingers ominously in the air is the extremely high levels of Open Interest in Ethereum’s derivatives market. Leveraging bets like this can be a double-edged sword—promising vast returns while equally capable of inducing severe losses. Leveraged positions create an echo chamber that amplifies both bullish and bearish sentiments. For those unwilling to risk a sharper pullback, caution appears to be the best course of action—at least until the dust settles around these overextended market conditions.

The Alarming Surge and Possible Altseason

With Ethereum powering up by over 50% in mere days, excitement has built across the crypto realm. Some traders posit that this surge could herald the long-awaited “altseason,” a time when alternative cryptocurrencies reclaim traders’ attention. Yet even amidst this optimism, skepticism prevails. Market trends are notorious for their volatility, and Ethereum’s sudden rise can serve as a tailspin for unprepared traders.

The euphoria stemming from an altseason can turn into unmitigated panic when the market turns sour. Are investors prepared for such emotional churn? The risk looms large, especially if a significant correction aligns with the ‘greater fool’ theory— where investors may be buying not based on fundamentals but rather the hope that someone will pay an even higher price down the line.

Understanding the Long-term Picture

In the grander scheme, Ethereum’s emphatic return to form may hide deeper issues in its underlying structure. While the price has rebounded strongly, one must consider the broader implications of such price action. After all, short-term trading insights often clash with fundamental ethos in the crypto world. Ethereum must not only show strength in maintaining its recent gains, it also needs a narrative—a story that can capture the imagination of both seasoned investors and newcomers alike.

However, the question should be raised: is the blockchain capable of sustaining innovation in the long run? A consistently high-volume trade must translate into tangible growth; otherwise, it could become a flash in the pan. Ethereum’s ability to revive itself after prolonged bear markets and adapt to shifting market needs will ultimately determine whether it can maintain its status as a key player in the blockchain arena.

The Tightrope Walk Between Caution and Opportunity

As the price teeters around $2,565 following a formidable rally, the environment rings with tension. It’s a tightrope walk between opportunity and risk. Volumes are slowly dwindling and the market is rife with indecision—a precarious moment that could either usher in a refreshing phase of sustainable growth or plummet into a world of uncertainties.

Investors should remain vigilant, especially given the technical indicators pointing toward a possible retest of the $2,400 mark. The transition from exuberant highs to cautious lows can be abrupt, but the allure of potential winnings reigns supreme in the minds of those who dare. Ethereum’s future could still shine brightly, yet only if its community understands that powerful rallies often come with equally powerful corrections. Thus, staying informed and soberly realistic amidst the chaos will be crucial in navigating the bustling world of Ethereum trading.