In recent weeks, Ethereum has found itself under considerable strain, trapped within a tight trading range that has left many investors uncertain about its future. The cryptocurrency, which has previously exhibited remarkable resilience, is now hovering around $1,610—a significant drop from its former threshold of support near $2,000. The market’s general malaise, exacerbated by rising global tensions, particularly between the United States and China, only serves to amplify the unease. As geopolitical dynamics evolve, fluctuations in trade policies and tariffs promote a climate of unpredictability that could impact the cryptocurrency sector adversely.

This heightened uncertainty stems not only from crumbling trust in traditional markets but also from ongoing dialogue concerning cryptocurrency regulations. Add to this the fact that many investors are retreating to safer havens, and it’s clear that Ethereum’s revival is contingent upon more than just technical analysis. The emotional landscape of potential buyers is fragile; trust must be re-established before momentum can return.

The MVRV Band: A Beacon of Hope or a False Dawn?

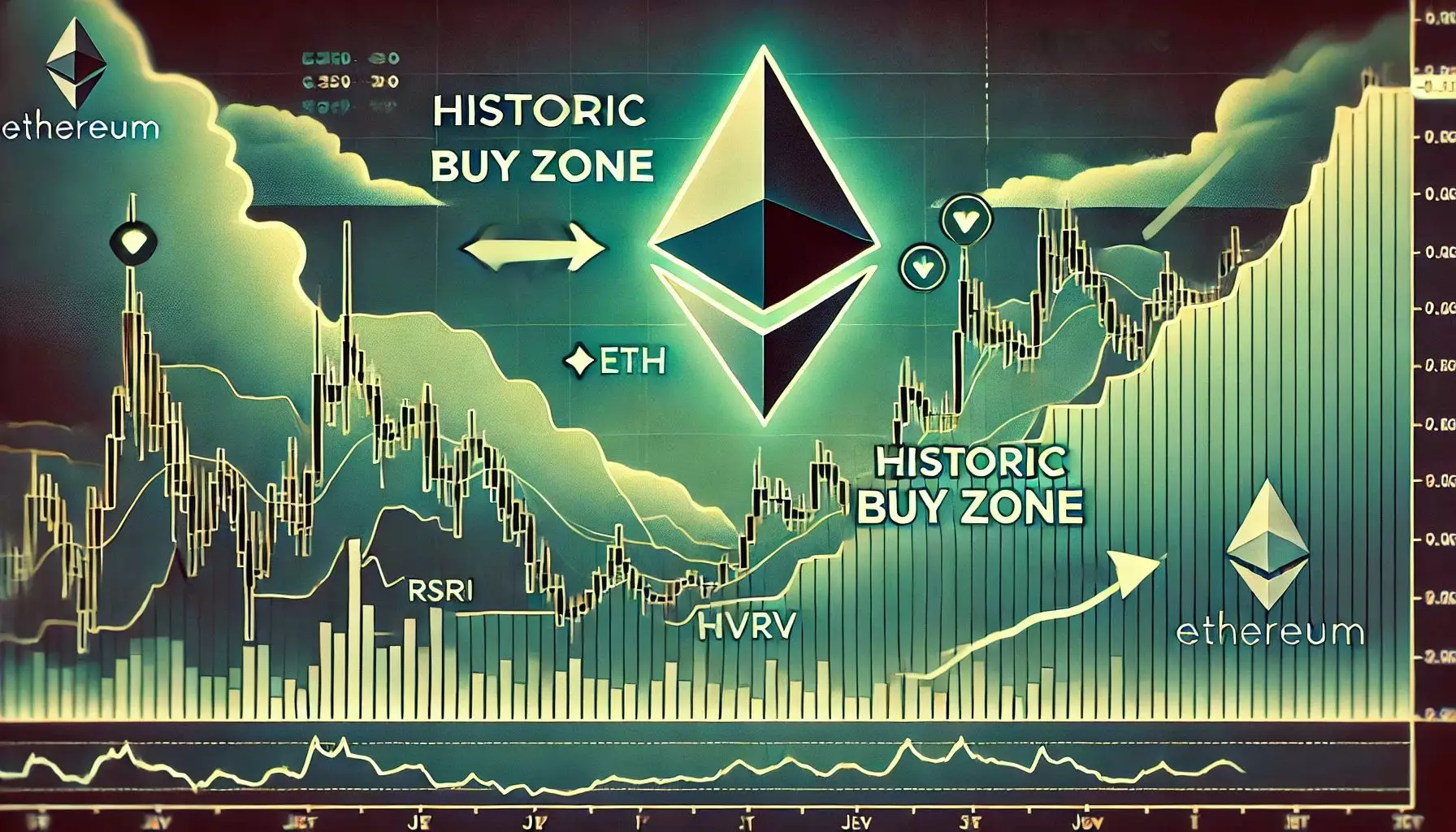

Interestingly, analysts like Ali Martinez suggest that Ethereum’s current position—trading beneath the lower bounds of the Market Value to Realized Value (MVRV) Price Band—could signal an opportune moment for savvy investors. Historically, significant accumulation has occurred when prices dip into this undervalued territory, creating fear-induced buying opportunities. It’s a tantalizing prospect, and one that positions Ethereum as a potential diamond amidst the rubble of bearish sentiment.

However, relying solely on this metric without considering external macroeconomic conditions could be misleading. If the broader market continues to recoil under pressure from geopolitical negativities, the hopeful narrative surrounding Ethereum could quickly turn into a cautionary tale. Indeed, history has taught us that just because a price is low doesn’t mean it can’t go lower—and that cautious optimism may not suffice in a shaky market.

Technical Resistance: Bulls Need a Breakthrough

The bulls, those optimistic market participants prepared to engage, are currently caught in a difficult position. To turn the tide and cultivate renewed market enthusiasm, Ethereum must decisively push beyond the crucial $1,700 resistance level and ultimately reclaim the $2,000 mark. These are not merely numerical thresholds; they symbolize psychological barriers that resonate deeply within the trading community.

A breakout above $2,000 could reignite buying interest, leading to a potential rally. However, falling below support at $1,550 would speak volumes about the loss of momentum and could invite further adverse movements, potentially dragging prices down to the $1,500 region. This seesaw scenario between accumulation and impending doom is not merely a matter of price; it encapsulates the battle for the very soul of Ethereum among traders and investors swaying between greed and fear.

The Role of Geopolitical Tensions

As we delve deeper into the impacts of global tensions, it becomes evident that such conflicts aren’t just nuisances—they’re seismic forces that can shape financial markets. The ongoing trade spat between the US and China is perhaps more than just a sidebar in discussing Ethereum’s price; it has far-reaching implications. Crypto is often regarded as an alternative asset during uncertain times, yet the current swell of pessimism around trade could overshadow any potential benefits.

As tariffs loom and various sectors reel from their effects, cryptocurrencies may fall victim to the same wave of investor retreat that afflicts traditional equities. An investment in Ethereum today demands more from its backers than economic insight; understanding the interplay of international relations, trade strategies, and supply chains becomes essential.

Preparing for Turbulent Waters

Given the prevailing sentiment, traders should brace for a landscape featuring volatility and consolidation. The nature of the market suggests that many participants are sitting on the sidelines, waiting for signs that are yet to materialize. Such periods of indecision can precede explosive movements in either direction. Therefore, developing a foresight strategy—whether that means preparing for accumulation or adjusting expectations for further declines—is essential in navigating this choppy sea.

Ethereum stands at a crossroads, captivating the interest and speculation of investors everywhere. It has the potential to rebound and secure a strong position in the ever-evolving cryptocurrency landscape, but only if it can overcome immediate hurdles and the turbulent geopolitical climate. The stakes are undeniably high, with the path forward shrouded in a mix of risk and opportunity. The question remains: will the bulls rise dramatic and seize the moment, or will they succumb to the prevailing bearish trends?