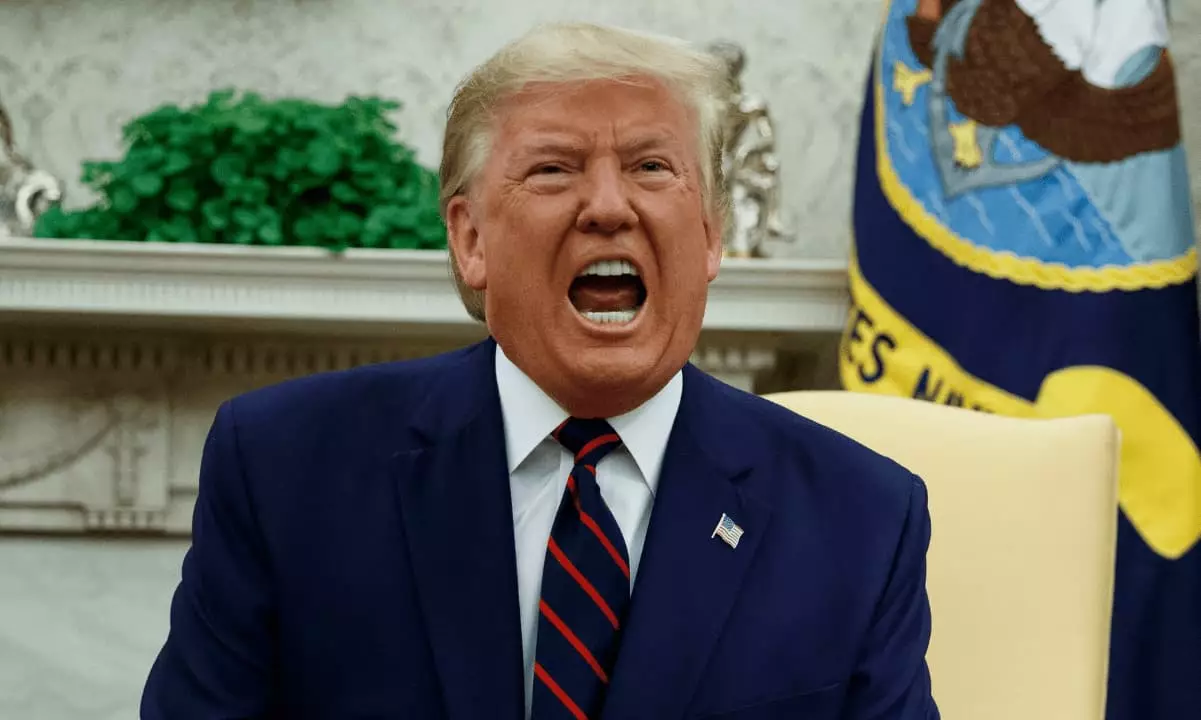

The cryptocurrency landscape has evolved at a breakneck pace, and now it has entangled itself in one of the most contentious figures in modern politics: Donald Trump. Recently, high-ranking House Democrats have initiated a detailed inquiry into the financial maneuvers of Trump’s crypto-related enterprises, which raises essential questions about the intersection of politics and pioneering financial technologies. The ramifications of this inquiry extend far beyond partisan lines; they challenge the very framework of ethical governance amid the fast-paced growth of cryptocurrencies.

Coinciding with the explosive growth of digital currencies, our political landscape is witnessing an unprecedented convergence of fundraising, foreign interests, and the potential malfeasance that often accompanies massive financial operations. These concerns culminate in significant doubts surrounding Trump’s financial dealings, particularly his Republican fundraising outlet, WinRed, and its controversial association with dubious political action committees and crypto enterprises.

Whispers of Corruption: A Suspicious Landscape

The inquiry by Democrats, led by intent lawmakers such as Gerald Connolly, Joseph Morelle, and Jamie Raskin, serves as both a legal process and a moral awakening. Their letter specifically requests access to all suspicious activity reports pertaining to Trump’s fundraising, signaling that the stakes involve not merely compliance with financial regulations but also potential criminality. This is no small matter.

The scrutiny intensifies around the World Liberty Financial (WLF) and its WLFI token sale, which raised eyebrows when a mysterious $75 million investment from Justin Sun, a figure already under the SEC microscope, was uncovered. Here, we can observe a disconcerting but common theme in political finance: the dance of power with money.

When figures like Sun enter the mix, suspicions inevitably arise. Is he buying influence or just tapping into an investment opportunity? The nuances escape even seasoned analysts; however, the skepticism remains palpable. As questions of foreign influence loom over these crypto ventures, the intricate layers of greed and governance become increasingly tangled.

The Risk of Foreign Influence

The implications become alarming when considering accusations of insider trading coupled with potential pump-and-dump schemes surrounding meme coins like TRUMP and MELANIA. With entities linked to Trump reportedly controlling 80% of the supply, the scenario becomes rich for exploitation and corruption. Such activities not only threaten financial stability; they also jeopardize national security by potentially allowing foreign investors, many suspected to be Chinese nationals, to exert influence over American policy.

The anonymity of cryptocurrency transactions gives rise to concerns that are too pressing to ignore. With foreign players potentially reaping profits while American civilians incur losses—over $2 billion lost due to market manipulation—it is a sobering reminder of how out-of-control speculation can rapidly escalate from mere financial shenanigans to a dire national concern.

Potentially Dangerous Conflicts of Interest

At the heart of the controversy lies a broader philosophical concern: the ethical implications of a sitting president mingling personal business interests with public service. The announcement of WLF’s stablecoin, USD1, alongside a foreign fund preparing for a $2 billion investment in Binance—a platform previously convicted of violating U.S. anti-money laundering regulations—stirs troubling speculation about motives and forethought.

This deal highlights clear conflicts of interest wherein personal finance not only mixes with political influence but also jeopardizes public trust. It is essential for lawmakers to act decisively against these clouded maneuvers, lest we derail democracy itself by allowing business and politics to collide in a Cyberspace filled with ambiguity.

The Call for Regulation Intensifies

As public scrutiny mounts, a surge of legislation is emerging within Congress aimed at curbing the potential abuses linked to cryptocurrency. With proposals like the GENIUS Act and various initiatives to ban sitting presidents and congressional members from profiting off meme coins gaining traction, the implications foster a fascinating dynamic in American governance. It shows a growing recognition that transparency and ethical behavior must prevail in all aspects of leadership.

Legislators are under increasing public pressure to confront the complexities of regulating cryptocurrencies as both political campaigns and digital finance continue to intertwine. The landscape is fraught with challenges, and what remains is an urgent need for concrete actions that preserve both democracy and the advancements of innovation in the financial sector.

As these inquiries unfold, we find ourselves standing at a crossroads where technological advancement must align with ethical responsibility, or we risk allowing a new breed of corruption to undermine the very fabric of our political structure. The intricate tapestry of power, money, and influence has never been more contentious, urging a necessity for reform that safeguards our society.