Ethereum, the second-largest player in the cryptocurrency market, finds itself ensnared in an unsettling reality, struggling to breach the psychological barrier of $2,000. Trading in a narrow band between $1,800 and $1,900, the market has become a cage of uncertainty as bullish momentum dwindles. While advocates of cryptocurrency often tout its irreversible advantages and revolutionary potential, the current landscape serves as a harsh reminder that the vagaries of external economic factors can profoundly impact digital assets. Investors are apprehensive; many investors are anxiously clutching their wallets while anxiously watching the market plot its next move.

A Technical Snapshot: The Critical Trendline

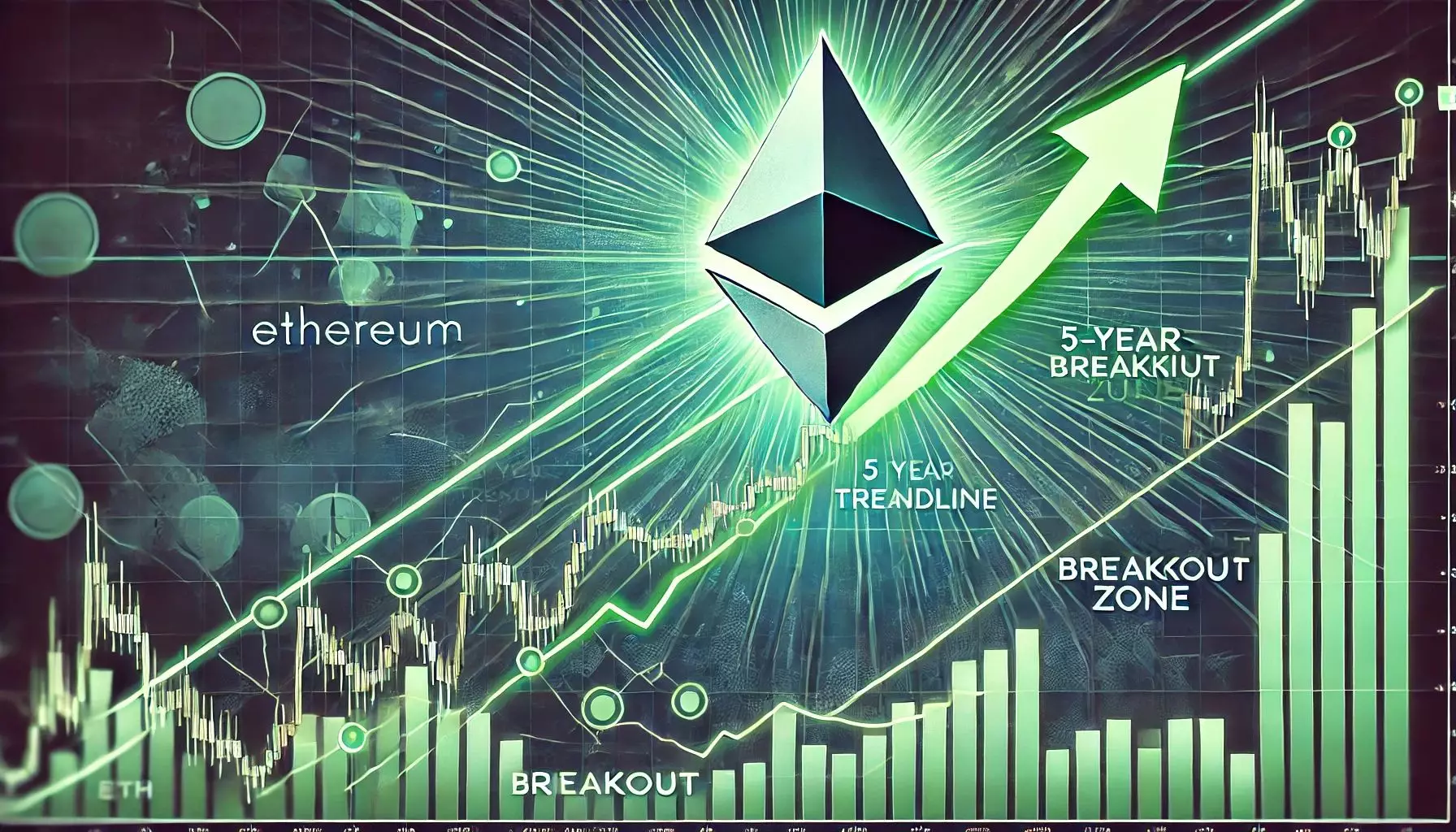

Prominent analysts are closely monitoring the situation, notably Mister Crypto, whose evaluation of Ethereum’s technical position reveals that it is currently hovering near a historically significant trendline. This line has provided support during previous corrections over the last five years. The importance of this support level cannot be understated: many analysts suggest that should Ethereum fail to maintain this line, we’re likely to see a cascade of bearish sentiment that would push the asset further down the rabbit hole of decline.

The technical indicators paint a dire picture. The potential for Ethereum to spiral into a new sell-off phase looms large, with whispers buzzing about a retest of lower demand zones near $1,600 to $1,700 if the prevailing trendline fails to hold up. An environment of mounting skepticism—and the inexorable weight of macroeconomic conditions—certainly feeds into the general doom and gloom that seems to be enveloping the marketplace. Herein lies the crux: can Ethereum withstand such pressure, or is it destined for deeper depths?

The Macro Landscape: Economic Shaking Grounds

Uncertainty on a larger scale is a major contributor to Ethereum’s precarious position. Rising tensions in global trade coupled with ambiguous regulatory stances on a national level generate an atmosphere of volatility that not only affects digital currencies like Ethereum but also has the U.S. stock markets teetering on the edge. The lack of clarity and intricate web of economic instability leads investors to exhibit risk-averse behavior, thereby reinforcing Ethereum’s battles against substantial selling pressure.

In this climate, it’s easy to see why the general sentiment among crypto investors is laced with skepticism. Economic indicators blink yellow, signaling warnings while inflation looms ominously on the horizon. The prevailing narrative suggests that this isn’t merely a transient dip for Ethereum; it’s a fundamental challenge of identity—one that demands resilience and innovative strategies from its proponents if they want to chart a path towards recovery.

The Path Forward: A Fork in the Road

While pessimism abounds, it’s crucial to note that some expert analyses do hold an optimistic outlook regarding Ethereum’s potential for recovery. The discussion around the 5-year trendline presents a glimmer of hope. If Ethereum can find its footing above this line, proponents argue that a robust rebound might be within reach, possibly catapulting the asset back toward elusive territories above $2,000.

In the upcoming weeks, both bulls and bears will clash in a decisive battle at this critical juncture. The stakes are high: for Ethereum to resurrect itself, reclaiming $2,300 must become the primary objective. This price point is not just a number—it represents a significant psychological and technical milestone, reinforcing the narrative of resilience that proponents of Ethereum have fiercely advocated. However, in failing to hold above the critical moving averages, the scene could quickly unravel, laying the groundwork for a feeble market plagued by further declines.

A Call for Vigilance: The Tribalism of Cryptos

The drama surrounding Ethereum is a microcosm for the larger tribalism within the cryptocurrency space. Advocates and skeptics often find themselves locked in an ideological battle, each preaching the merits or perils of digital currency. Yet, amid this discourse, the sound judgment of risk and resilience can often be drowned out. As Ethereum navigates this rocky landscape, it beckons investors to engage with informed skepticism—an approach that balances collective enthusiasm with calculated caution.

In the wake of such volatility, it becomes undeniably clear that Ethereum’s true challenge lies not only in its price trajectories but also in the overarching forces of market sentiment, regulation, and macroeconomic dynamics. The coming weeks offer a potentially defining moment for Ethereum; amid the noise and fervor, one thing is certain: the resilience of crypto ethos will be tested as never before.